Against the backdrop of anti-ESG sentiment among many global institutional investors, new analysis from independent consultancy Barnett Waddingham (BW) reveals that defined contribution (DC) schemes in the UK are swimming against that tide and increasing their allocations to funds with climate targets.

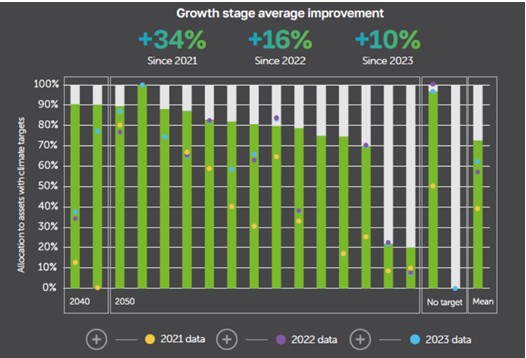

The research, conducted annually by BW, found that most pension providers continue to recognise the financial materiality of sustainability issues, with a 34% increase in allocations to funds with a climate target in the growth stage since BW’s first DC sustainability report in 2021.

Despite this increased appetite for ESG solutions, the research has found that 35% of DC scheme growth assets are exposed to investment managers who have stepped away from climate collaboration initiatives.

BlackRock, Vanguard, State Street and Northern Trust have all recently exited the Net Zero Asset Managers (NZAM) initiative and Climate Action 100+ (CA100+). The total assets under management of these firms stands at $25 trillion USD - representing roughly a quarter of global GDP in 2024.

These exits are part of a broader trend, with 71 investors leaving CA100+ since June 2023. This exodus has been triggered by growing anti-sustainability sentiment, particularly in the US, exemplified by accusations that asset managers are overstepping their fiduciary duties, which has even led to legal action by 11 US states.

Many managers have justified their exits by citing their ability to manage climate risks independently and continue to invest in a manner that supports stewardship and sustainable investing.

DC scheme reactions

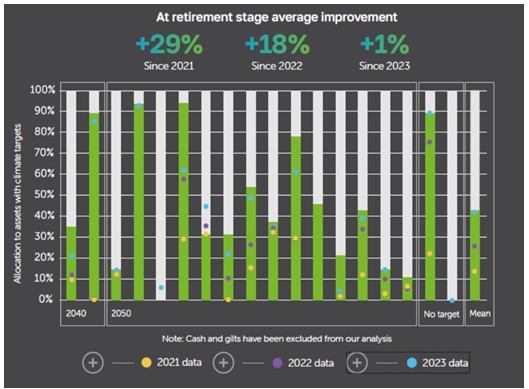

BW’s research has revealed that there is a clear and accelerating trend among DC scheme providers to embed carbon emission reductions into their default strategies.

As shown in the below graphs, this shift has gained significant momentum over the past four years, demonstrating tangible progress in aligning portfolios with global targets and the Paris Agreement.

This comes alongside many providers asserting their role as stewards of capital, making it clear that fund managers must step up, with a recent investor coalition led by The People’s Pension calling on managers to develop and evidence robust stewardship strategies. The pension scheme recently moved £28 billion in assets away from State Street, in part due to concerns over the firm's stewardship practices and alignment with their sustainability objectives.

Moving forward - a tale of two cities

Where DC providers back ESG, but investment managers do not, the industry must find a way forward to achieve the best outcomes for members.

Firstly, BW is calling on the industry to embrace complexity when it comes to ESG. High scores in leaderboards don’t necessarily mean providers are driving meaningful change, while schemes scoring more lowly are not always failing their members on climate initiatives. Of the strategies researched by BW, fifteen have net zero by 2050 targets, with three targeting 2040 and two without a target. However, the UN has warned the chance of achieving a global net zero target by 2050 is now “virtually zero.”

This stark reality means DC providers face trade-offs and cannot blindly reduce emissions. They must regularly reassess their net zero targets to manage unintended financial risks. For example, portfolios could become highly concentrated if there is a limited pool of investible opportunities consistent with their climate goals. A key test will be interim targets set with reference to 2030. Providers should not be afraid to recalibrate accordingly, as delivering for members means balancing portfolio decarbonisation with managing climate transition and physical financial risks and, as much as possible, driving lower real-world emissions.

Then, for those DC providers facing a difference in opinion with their investment managers, BW is calling on providers to improve their monitoring, take more control of voting, and take an active role in reviewing manager decisions and initiatives.

Sonia Kataora, Partner and Head of DC Investment at BW, comments: “Despite the winds of change blowing in a new direction, DC providers are holding firm and sticking to their guns on sustainability. This is critical if they are to uphold their roles as stewards of capital, achieving the best outcomes for members financially.

“It is certainly a tumultuous time, both in terms of the global anti-ESG backlash and the seismic changes to policy and structure of pensions coming from the upper echelons of the UK Government. Those pushing for minimum size thresholds for DC providers must remember that scale alone does not guarantee sophistication.

“Of course, scale can amplify impact. Larger providers can wield significant influence by directing capital away from underperforming managers, and they have a unique position to push for stronger stewardship and set higher standards for responsible investment. But smaller schemes can also use their powers effectively, focusing their resources on the things that really matter to their members and collaborating to impact policy; some of the leaders of the pack on good ESG are smaller schemes.”

|