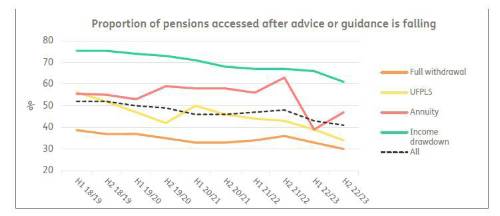

New figures from the Financial Conduct Authority this week1 show that 58% of pensions accessed in 2022/23 did not receive advice or guidance, compared to 48% in 2018/19. Nearly 429,000 pensions were accessed without professional help compared to 314,000 five years earlier.

Use of advice or guidance is lower in all categories of pensions compared to 2018/19 but is most marked in drawdown where the proportion taken with professional support has fallen from 75% to 61% and among UFPLS withdrawals where it has declined from 56% to 34%.

“Given the complexity of retirement decisions, this trend towards more pensions being accessed without professional advice or guidance looks like a massive red flag,” said Stephen Lowe, group communications director at retirement specialist Just Group.

“Retirement decisions are some of the trickiest financial decisions that people will ever face. Yet the majority are shunning not only paid-for advice but even the government’s free, independent and impartial pension guidance offered by Pension Wise which was created to help everyone accessing a pension.”

Stephen Lowe said that the figures bode badly for the future when increasing numbers will be dependent on defined contribution pensions to supplement their State Pensions.

“We are now in the 10th year of the pension ‘freedom and choice’ policy and, while people are obviously enjoying having access to pension cash when they want, these are still relatively early days in terms of understanding whether people are managing those withdrawals sustainably.

“It does reinforce the need for the industry to develop and promote advice models that can help people plan their retirement finances and for the government to work harder to encourage many more people to take up their entitlement to the highly-regarded guidance from Pension Wise”

|