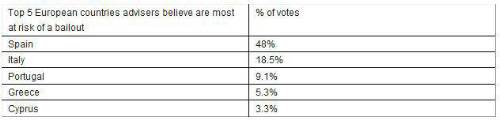

Vast majority of UK financial advisers (90%) believed further ‘bailouts’ of weak European countries would be required with Spain the most vulnerable.

However, this data was collected* before the European Central Bank’s (ECB) announcement on 6th September that it intends to launch a potentially unlimited bond buying programme, which will undoubtedly help to reassure financial advisers.

The data highlights the regions where adviser confidence is lowest:

Interestingly Greece received only 5% of votes despite its highly publicised troubles, suggesting advisers are primarily concerned with the problems in larger European states (Spain and Italy.)

The ongoing European debt crisis continues to be the biggest perceived threat to the UK economy, receiving 66% of adviser votes (up 10% from Q2). Not only is this holding back overall adviser confidence (which is rated as 5.2 on a scale of 1 to 10, with 10 being the most confident), but is likely to also impact investment decisions the advisers make, with some advisers potentially avoiding mainland Europe.

The latest ECB announcement could lead to overall confidence improving, and possibly a renewed interest in investing within those countries. Mainland Europe could become an appealing place to invest and in particular the announcement could boost interest in European equities, which are cheap and unloved by most investors at present.

Rupert Watson, Head of Asset Allocation at Skandia Investment Group, comments:

“The announcement that the ECB will step in to provide further support to weak European economies will come as no surprise to UK financial advisors, many of whom felt that extra bailouts would be necessary. Spain clearly remains in focus, although Greece, Ireland and Portugal will probably also need further official support. The ECB's plan to intervene in the EU bond market suggests that it has stepped up its fight to support the Eurozone, and will help to ease UK adviser’s concerns over the debt crisis. While the peripheral economies are likely to remain in or close to recession for many years to come the ECB’s actions are highly significant and may help start a process of healing for the global economy.”

|