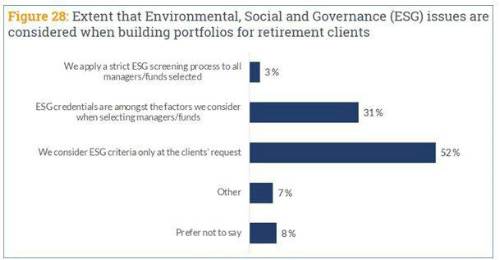

While there has been a significant shift towards to responsible investing within the industry, advisers highlight that requests from retirement clients to integrate ESG funds into their portfolios remain low. Despite this, advisers are still taking action and almost one third (31%) said ESG credentials are amongst the factors they consider when building portfolios. A further 3% said they apply a strict ESG screening process to all funds selected for retirement clients.

Figure 28. Aegon Next Wealth Managing Lifetime Wealth: retirement planning in the UK

Adviser interviews underlined there are still questions on how to determine a client’s ESG preferences. ESG means different things for different people so understanding how to translate this into an investment portfolio can be challenging. One adviser said:

“The problem we have is clients can be quite specific, like avoid tobacco or arms….and when we drill down, one of the funds we use on the advisory side of the business will invest in something they don’t agree with.”

Most advisers agreed that there needs to be better standards in data and language to support wider adoption of ESG approaches to investing. Firms have generally developed their own way to determine their clients’ ethical considerations but are looking for clear industry standardisation and taxonomy that supports translating this into investment portfolios. Another adviser said:

“What we’re constantly looking for is some sort of industry taxonomy such that we can actually have a sensible conversation about [ESG integration]. We’ve developed our own in a way to lead people to where we think the answer is…but every client is going to be different.”

Tim Orton, Managing Director for Investment Solutions at Aegon, comments: “We have seen a sea-change in responsible investing with individuals increasingly looking for answers on how their investments are contributing to real-world change. This has been furthered by increased regulation and momentum from the government pushing forward it’s green agenda for investments.

“The research shows advisers are taking this seriously and considering ESG factors when building portfolios, even if demand amongst retirement clients hasn’t yet caught up with the wider investment community.

“The lack of industry standardisation, however, means advisers face challenges when dealing with the different ethical considerations of their clients. Firms have developed their own approaches, but as the industry shifts towards greater ESG adoption, more work is needed to support advisers to better compare ESG funds and explain strategies when building portfolios.”

Managing Lifetime Wealth: retirement planning in the UK

|