This Halloween, it’s not just ghosts and ghouls giving people the chills – for some, pensions are proving just as frightening. New research from Standard Life reveals that one in ten (10%) feel too overwhelmed to even look at their pension, and nearly a third (26%) have no idea how much they’ve saved so far.

In a world where 83% of people say things feel more uncertain than they did a few years ago, it’s no surprise that pensions are being pushed to the shadows. Nearly half (47%) believe their retirement finances are influenced by forces beyond their control, adding to the sense of dread.

With 45% of people saying ongoing cost of living pressures have caused them stress, it’s no surprise that many are focused on day-to-day survival rather than long-term planning. However, it’s worth taking a peek behind the curtain – ignoring your pension could mean missing out on a more secure retirement.

Exorcise your pension demons

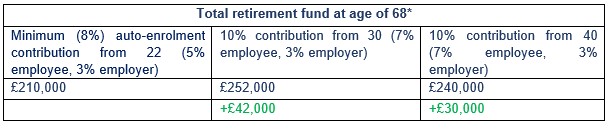

Those who are unable to face their pension fears might find that they are under-saving for retirement – however, even small changes can make a big difference. Standard Life analysis shows that someone earning £25,000 and paying the minimum auto-enrolment contributions (5% employee, 3% employer) from age 22 could build a pension pot of around £210,000 by age 68, adjusted for inflation. However, someone who faced their pension fears, realised they were set to fall short of their retirement expectations and increased their contributions by 2% at the age of 30 could boost that to £252,000 - £42,000 more, in today’s prices. Someone who faced the pension skeleton in their closet at the age of 40 and took the same action could increase their pot at 68 to £240,000, adjusted for inflation.

*assuming 3.50% salary growth per year, and 5% a year investment growth. Figures account for 2% inflation. Annual Management Charge of 0.75% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

Mike Ambery, Retirement Savings Director at Standard Life, part of Phoenix Group, said: “It might feel frightening to face your pension, but the real horror is ignoring it. People often tell themselves they’ll ‘deal with it later’, but that can mean storing up a fright for their future selves. This Halloween, it’s worth facing what’s lurking in the shadows – because understanding where you are with your retirement savings doesn’t have to be scary. A few minutes spent checking your balance or reviewing your contributions today could make a world of difference tomorrow.

“Small changes can cast a powerful spell over your financial future. Even relatively modest increases to your pension contributions can add up to tens of thousands more by the time you retire – thanks to the magic of compound investment growth. By facing your fears now, you can look forward to a future that feels a lot less chilling – and a lot more secure.”

Mike’s hints and tips for a less scary retirement:

1. Don’t fear the login

“The scariest part is often just getting started. If you’re set up to view your pension online, log in to your pension account or app and check how much you’ve saved so far - seeing the numbers can turn unknown fears into clear goals. If you’re not sure how to access your pension online, get in touch with your provider.”

2. Summon all your pensions

“If you’ve changed jobs over the years, you might have old workplace pensions gathering dust. Tracking them down and combining them where appropriate can make it easier to keep an eye on your total savings – the government’s pension tracing tool is a good first stop.”

3. Cast a small spell — and increase your contributions

“Even a small bump in your monthly contributions can make a big difference over time -. a 2–3% increase now could add thousands to your retirement pot later. Regular contributions are the pension equivalent of feeding the Gremlins after midnight – let that compound investment growth off its leash.”

4. Don’t let inflation be the monster under the bed

“Make sure your money is working hard for you – and beating inflation. Review your investment choices once a year and consider whether they’re keeping pace with long-term inflation.”

5. Confront the ghost of your future self

“Think about what kind of lifestyle you want in retirement. Pensions UK's Retirement Living Standards offer a powerful visualisation of what each different levels of retirement income could mean. When you have an idea, online pension calculators can help you see whether you’re on track - and what changes might help you get there.”

6. Seek expert help before things go bump in the night

“If your pension still feels like a haunted maze, consider speaking to a financial adviser if possible – they will be able to give you personalised advice, tailored to your induvial situation. It’s also worth accessing free guidance services like the government’s Pension Wise. A bit of expert support can help you to banish uncertainty.”

|