-

Fidelity launches new offer1 for savers and retirees bringing pension pots together

-

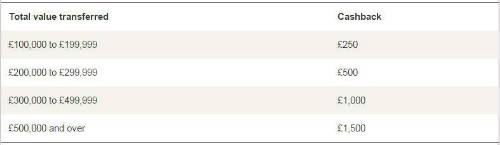

Tiered cash back between £250 and £1,500

Depending on the amount transferred, customers could earn between £250 and £1,500 cash back1 if they move their pension savings into a Fidelity SIPP before the 18th December 2015. In order to be eligible for the deal, savers must transfer a minimum of £100,000.

The offer is open to both new and existing customers either looking to tidy up their pension arrangements or considering taking advantage of the new freedoms

Fidelity will pay up to £500 in total exit fees2 imposed by current pension providers as standard.

Furthermore, customers who wish to check any small print on their pension pots can also have an initial free chat with Fidelity’s Retirement Service before switching3.

Jonathan Hewitt, Head of Personal Investing at Fidelity International comments:

“By encouraging savers and retirees to bring their pension pots together, Fidelity customers would not only benefit from the cash back but also the opportunity to leave schemes with high exit charges.

“For those customers who wish to access the new pension freedoms, this is particularly relevant. There is more choice than ever before yet the freedoms have not been uniform with some retirees coming up against exit charges, restrictions on how they access their monies or realising that their pots have a variety of charges; some of which are costly.

“Consolidation can be very beneficial as it allows savers and retirees to organise their finances, avoid duplicate charges and, in turn, help them plan for the future. Saying this, we would always urge consumers to double check the small print on their pots – some offer preferential rates for example. If in doubt, retirees should seek out high quality, expert help either through Fidelity Retirement Service or other sources.”

|