Dan Coatsworth, head of markets at AJ Bell, comments: “It’s time to break out the champagne as UK stock markets have delivered a New Year’s treat. “The FTSE 100 hit the 10,000 jackpot level immediately after rounding off a tremendous year for UK shares. This is a historic moment and already makes 2026 one of the most significant years for the blue-chip index since its launch in 1984.

“Breaking through the 10,000 level is the best New Year’s present Chancellor Rachel Reeves could want. She has been banging the drum about the merits of investing over parking cash in the bank, and the FTSE 100’s achievements just go to show what’s possible when buying UK shares. It also proves to cynics that the UK market is not stuck in the mud, and that the US stock market is not the only place to make money.

Why has the FTSE 100 done well over the past year?

“The FTSE 100 beat the flagship US index, the S&P 500, in 2025 thanks to its diverse range of industries offering a tonic to investors who started to get the jitters about tech stocks.

“Investors have faced considerable uncertainty, and many have looked away from the US for opportunities. They’ve focused on cheaper areas of the market, of which the UK is one.

“We’ve seen increased interest from foreign investors looking to diversify their holdings and the FTSE 100 has also shone during the more tumultuous periods thanks to its plethora of defensive-style companies.

“When everything looks gloomy or chaotic, such as in the depths of the Liberation Day fallout, investors often seek solace in companies whose goods and services should be in demand no matter what’s happening in the world. For example, we all need to pay insurance or water bills, or those in the habit are still likely to buy cigarettes or vapes, and the FTSE 100 has plenty of companies playing on these themes on offer.

“Other tailwinds for the FTSE 100 over the past year include the sharp rise in the price of gold and silver which has benefited the likes of Fresnillo and Endeavour Mining. A push for more governments to spend on defence has also improved the earnings prospects for contractors such as Babcock, with defence another sector well-represented on the UK stock market.

“Lots of people have criticised the UK for being an old economy market, full of boring companies in the banking and natural resources sector. Yes, it lacks the excitement of go-go-growth stocks omnipresent in the US, but boring can also be beautiful when it comes to investing. The UK is a rich hunting ground for dividends, and it is also full of companies that have slow but steady growth and which are underappreciated engines for wealth creation.

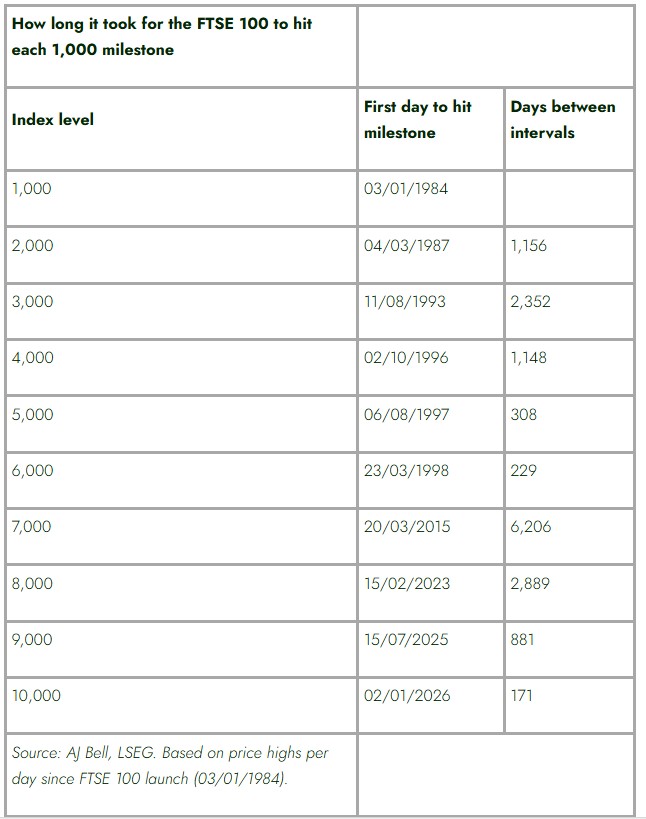

How long did it take to hit previous 1,000 increments?

“It’s only been 171 days since the FTSE 100 hit 9,000, so exceeding 10,000 at the start of 2026 makes it a record-breaking leap. Previously, the fastest jump in blocks of 1,000 happened when the FTSE 100 went from 5,000 to 6,000, which took 229 days in the late 90s.

|