Asset values increased over June while liability values remained stable, resulting in a modest increase in surplus to £50bn based on scheme’s own measures. This highlights the relative stability in the market, with the aggregate funding position staying out of a deficit for the last five months.

PwC’s Adjusted Funding Index, which incorporates strategic changes available for most pension funds, shows a £230bn surplus in pension schemes. The PwC Adjusted Funding Index takes into account available strategies such as a move away from low-yielding gilt investments to switching to invest in higher-return, income-generating assets. It also takes a more realistic approach to life expectancy changes. In comparison, other measures automatically factor in unrealised life expectancy increases when calculating total liability values.

Emma Morton, pensions actuary at PwC, said: “Trustees and sponsors should reflect on the fact that pension schemes are, on aggregate, in surplus. It’s not efficient to continue to pay money into a scheme that’s in surplus. While it’s right that schemes are run prudently, only those looking to transfer the scheme to an insurance company should consider deliberately building up a surplus, to cover the insurance premium that they will need to pay.

“Where sponsors are not planning to transfer their scheme to an insurance company, if they continue to pay cash into a well funded scheme, it’s inevitable that they will end up with a trapped surplus. Few scheme sponsors will be familiar with handling a trapped surplus, given pension scheme surpluses have been rare in recent history. It is notoriously difficult for sponsors to get a surplus back. Not only can it leave the funds tied up for years, but potential refunds would be subject to additional tax charges, higher than corporation tax rates.”

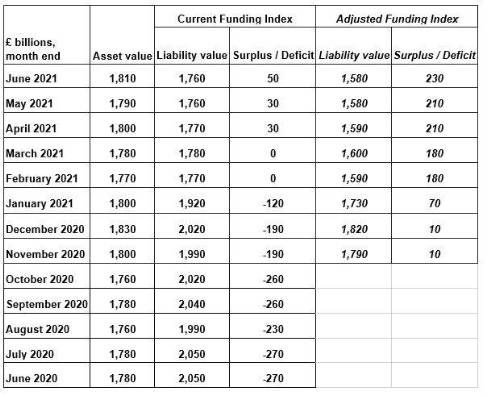

The PwC Pension Funding Index and PwC Adjusted Funding Index figures are as follows:

|