Pension saving might not come top of the pile for people in their twenties, when 40 might seem ancient, let alone 60 plus – however new analysis from Standard Life, part of Phoenix Group, reveals that saving sooner could leave you £40,000 better off in retirement.

The longer you wait to start contributing to your pension the more you could miss out on in future

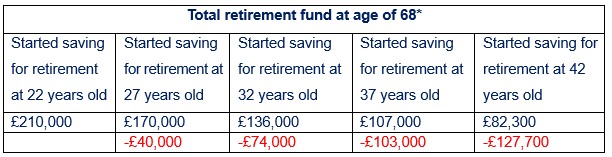

Standard Life’s analysis finds that those who begin working on a salary of £25,000 per year and pay the minimum monthly auto-enrolment contributions (5% employee, 3% employer) from the age of 22, could have a total retirement fund of £210,000 by the age of 68, adjusted for inflation. However, waiting just five years until age 27 to start contributing could result in a total pot of £170,000 – £40,000 less. Postponing for even longer could have an even bigger impact on a retirement pot:

*assuming 3.50% salary growth per year, and 5% a year investment growth. Figures account for 2% inflation. Annual Management Charge of 0.75% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

The key difference is that those who begin paying into their pension later in life could miss out on the power of compound investment growth. Of course, a balance must be struck between putting money away for future and meeting near term costs and goals, but these figures highlight the challenge that delaying saving for a number of years can create in the long-run.

Dean Butler, Managing Director for Retail Direct at Standard Life said: “Pension saving might not be the top of the priority list in your twenties, however it’s hugely beneficial to start contributing to a pension from an early age. Delaying saving in your 20s by as little as five years can reduce a retirement fund by tens of thousands as pounds – and by even more if you leave it longer. So, if your finances permit and your circumstances allow, the sooner you engage with and begin to contribute to your pension, the better your ultimate retirement outcome could be.

“While delaying entry into the workforce, for instance to pursue further education, can offer long-term benefits, both financially and personally, it’s important to be mindful that this might require you to contribute more later on to meet your retirement goals. Similarly, if you choose self-employment in your twenties, it’s worth opening a personal pension, as you won’t benefit from automatic enrolment via a workplace and could miss out on important early-career contributions.

“Our calculations show that contributing to your pension from the very start of your career maximises the potential compound investment growth and can result in a much larger retirement pot. For those in a position to do so, consistently paying into a pension from as early an age as possible and topping up payments, especially in your 20s, 30s or early 40s, can make a massive difference over time. The longer you wait to start the worse off you could be by the time you stop working, so if you’re able to save into a pension your future self is likely to thank you for it.”

Standard Life offers tips to maximise pensions savings:

1. Make sure you’re taking advantage of all the benefits of your pension plan and of the pension support offered by your employer. If your employer offers a matching scheme, for example, where if you pay additional contributions they will match them, consider paying in the maximum amount your employer will match to get the most out of it.

2. Getting a bonus this year, or receiving overtime pay? Deciding to pay some or all of your bonus into your pension plan could save you paying some big tax and national insurance deductions, meaning you could keep more of it in the long run. This could be a great way to give your pension savings a boost. Similarly, if you’re working overtime and you’re able to direct some of your overtime pay into your pension, even relatively small extra contributions can build up over time.

3. If you’re able to, think about paying a little more into your pension when you get a pay rise or have a little extra savings.

4. Keep an eye on your investments, the returns they’re giving you and whether they match the level of risk you’re comfortable with. Higher-risk investments potentially see more growth over the long term, but their value might go down and up more frequently and dramatically. Lower-risk investments, like particular types of bonds, are less likely to see drastic decreases in value, but you might not experience particularly significant growth with these. In your 20’s, you might feel happier with some higher-risk investment, as your pension has more time to potentially recover from dips in the market – but this won’t be right for everyone.

|