Brits are feeling the financial strain in the wake of the 2025 Budget, with Standard Life taking an immediate post-Budget temperature check of public sentiment. Its latest research1 reveals a stark 74 percentage point difference in confidence between younger and older generations - and anxiety ahead of major changes to salary sacrifice rules. The findings emerge at a pivotal moment for long-term savings policy, as people question whether future reforms will make it easier or harder to retire securely.

A Nation Divided on the 2025 Budget

Public sentiment towards the Budget is broadly negative, with overall approval standing at -8%. But age is the defining fault line:

Ages 55+: Approval plunges to net –37%, driven by dissatisfaction with tax rises and changes to ISAs and pensions.Ages 18 - 34: Sentiment flips to a more positive net +37%, suggesting younger adults see more upside in the Chancellor’s statement – the national living wage increase sees net support of +58%, and removing the child benefit cap stands at net +33%.

Strikingly, even measures aimed at shielding older households - such as maintaining the £20,000 cash ISA allowance for over-65’s, and ensuring the State Pension remains below the Personal Allowance for those who rely on it entirely – haven’t changed perceptions among older generations. This suggests deeper unease about the long-term impact of the Budget and the wider economy.

Meanwhile, people’s confidence that pensions will meet their retirement income needs has fallen by 10 percentage points year-on-year, highlighting a growing sense of concern.

Salary Sacrifice Shake-Up Deepens Concern

The Government’s planned overhaul of salary sacrifice for pension contributions - due in 2029 - is adding further uncertainty. Salary sacrifice allows employees to exchange part of their salary for employer pension contributions, reducing both tax and National Insurance, making it one of the most cost-efficient ways to save for retirement. With changes on the horizon, many worry the system may become less attractive and more complex.

Standard Life research found:

Almost one in five (18%) of all consumers are “very concerned” about the changes - jumping to a third (33%) among those earning £70k+.Of those who report concern the top impacts centre on financial hits and reduced incentives:

Almost half (46%) are concerned about having less incentive to save for retirementHalf (49%) of those earning £70k+ worry about the impact on future promotions or pay rises

One in five (19%) overall say the new rules may influence people accepting promotions or higher-paid roles, rising to two-fifths (41%) of those earning £70k+.

The hidden cost of frozen tax bands

The Budget confirmed that income tax thresholds will remain frozen until 2031, extending the current freeze by three years. Often described as a ‘stealth tax,’ this freeze gradually erodes take-home pay by pushing more workers into higher tax bands over time. Standard Life’s research reveals a significant generational divide on this announcement. Support for the move for 18–34-year-olds stands at net +36%, while net support for the over-55 age group falls to -29%.

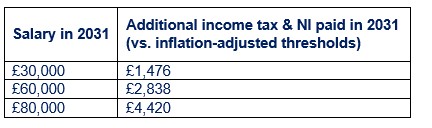

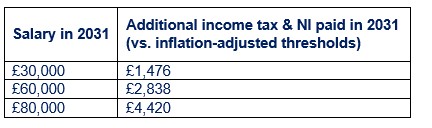

The financial impact is significant. In 2031, someone earning £30,000 will pay an extra £1,476 in income tax and National Insurance compared to if thresholds had increased with inflation since 2021 – the beginning of the freeze. For those on £60,000, the additional cost rises to £2,838, and for £80,000 earners, it climbs to £4,4202.

Mike Ambery, Retirement Savings Director at Standard Life, part of Phoenix Group said: “The Budget has landed very differently depending on where people are in life. Younger adults see room for optimism - many support steps like the rise in the national living wage, which perhaps gives them a sense that the system is beginning to move in their favour. However, it seems older generations feel as though the rug is being pulled under them at the worst possible moment. Even measures designed to shield retired households haven’t shifted that sentiment. This may reflect a more forward-looking concern – a sense that the system could become harder to navigate, and that future generations could face an even tougher environment.

“Salary sacrifice has been one of the most reliable tools for helping people make every pound of their savings go further. Changing it now risks making saving feel harder at a time when most people are already under-saving for retirement. Combine that with frozen tax bands quietly pushing more people into higher rates of tax, and the sense of financial pressure only grows. If the system becomes more complicated and less rewarding, people may lose trust in pensions – which is a risk none of us can afford.

“This is a moment for clarity and stability. Pensions are for the long-term and any future reform should give people more certainty about their future, not less.”

|