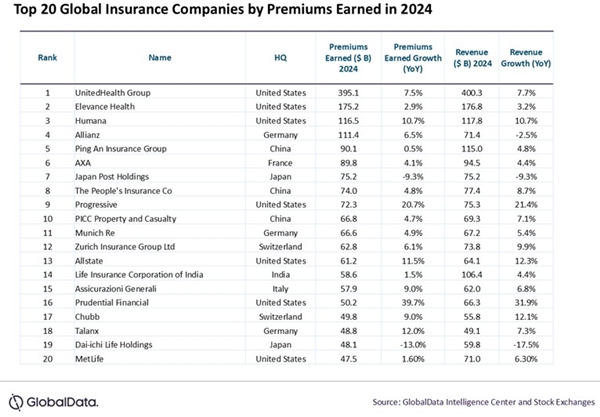

Consequently, the average premium earned of the top 20 global insurers year-on-year (YoY) grew by 6.8%, and overall top-line grew by 6.8%, reveals GlobalData. Of the top 20, 18 insurers reported YOY growth in premium earned in 2024, with the notable performers being Prudential Financial and Progressive.

Murthy Grandhi, Company Profiles Analyst at GlobalData, comments: “As global financial literacy continues to improve, a significant shift in consumer behaviour towards more proactive financial planning is evident. This trend is driving an increased demand for products that seamlessly integrate insurance with savings. Additionally, the rise in disposable income and the expansion of the middle class are broadening the customer base for life insurance products. Furthermore, the growing volatility in job markets and escalating healthcare costs are compelling consumers to seek out customizable insurance solutions that offer more than just fixed-term protection.”

Prudential Financial

Prudential has achieved an impressive 40% surge in premium earnings, driven by robust growth in its group disability business, including supplemental health products. This remarkable performance is further bolstered by increased third-party sales across a diverse range of offerings and a notable rise in variable life sales through Prudential Advisors.

Progressive Corporation

Progressive has reported a 20.7% growth in premium earnings, primarily driven by a rise in new personal auto applications resulting from enhanced advertising expenditures. Additionally, increase in personal auto rates and core commercial auto rates have contributed significantly to this growth.

Biggest losers

Dai-ichi Life Holdings experienced a significant decline in its earned premiums, down 13% at the back of decline in sales at The Dai-ichi Frontier Life Insurance Co., Ltd.

Japan Post Holdings experienced a 9.3% decline in premiums, attributed to a reduction in the number of policies in force and an increase in short-term expenses related to the rise in first-year new policies.

Grandhi adds: “GlobalData anticipates the global insurance sector to encounter a more complex operating environment in 2025. The ongoing geopolitical conflicts, such as the war in Ukraine and rising tensions in the Middle East are likely to escalate political risk exposure and disrupt global reinsurance capacity. Additionally, trade frictions and tariff escalations may adversely affect the global investment sentiment and heighten exposure to supply chain risks, prompting insurers to reassess their risk pricing models.”

Inflationary pressures are expected to persist, particularly impacting the motor and property segments, which will likely lead to continued premium rate increases. Insurers will also face heightened scrutiny regarding their cybersecurity preparedness considering the recent attacks that have revealed systemic vulnerabilities. Regulatory tightening across various jurisdictions is anticipated to raise compliance costs; however, it may also promote improved transparency and bolster consumer trust.

Grandhi concludes: “Demographic shifts, particularly the aging population, will sustain long-term demand for health, life, and retirement products. Insurers that maintain diversified portfolios, robust digital capabilities, and geographic breadth will be better positioned to navigate these challenges and seize growth opportunities in emerging markets. Premiums earned refers to the premium collected by an insurance company for the portion of a policy that has expired.

|