Many people make the switch from full to part-time work, out of choice or necessity – the reasons can include childcare, caring responsibilities and personal health as well as prioritising a manageable work/ life balance. The change has an obvious impact on earnings and new analysis from Standard Life, part of Phoenix Group highlights the potential pension impact as well as how part-time workers could make up the shortfall by increasing their contributions, if possible.

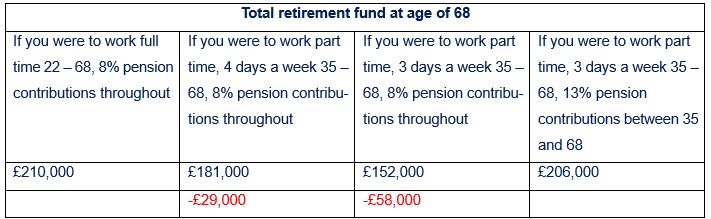

Standard Life’s analysis finds that someone that began working full-time with a salary of £25,000 per year and paid the minimum monthly auto-enrolment contributions (5% employee, 3% employer) from age of 22, could amass a total retirement fund of £210,000 by the age of 68* in real terms accounting for 2% inflation. However, if they were to switch to part-time (3 days a week) from the age of 35, they could build up a pot of £152,000 by the age of 68** again accounting for inflation – £58,000 less than if they remained working full-time. If they were able to increase their contributions to 13% when working part time (10% employee, 3% employer) they could build a pot of £206,000 in today’s prices – almost the same level as a full-time worker paying minimum contributions.

*if beginning working with a salary of £25,000 per year and contributing 8% (5% employee, 3% employer) monthly contributions into a workplace pension from the age of 22 and assuming 3.5% salary growth per year, and 5% investment growth. Figures reduced to take effect of inflation, assumed to be 2%. Annual Management Charge of 0.75% assumed. The figures are an illustration and are not guaranteed.

**It is assumed from the age 35 in this example that the salary is changed on a pro rata basis for the number of days worked each week.

Dean Butler, Managing Director for Retail Direct at Standard Life, part of Phoenix Group said: “Whether personal choice or not, part-time work is a good option for many and can help to balance an income with other responsibilities or interests. Whilst it isn’t always strictly a financial decision, going part-time does have an immediate impact on short-term finances as well as a long-term impact on retirement if you continue saving at the same level but with a lower salary to contribute from. It won’t always be possible, but if you can, increasing your pension contributions when you make the move to part-time work could go some way towards, or completely fill the gap.

“There’s always a trade-off involved but it’s worth keeping long-term savings in mind, and considering whether you’re on track for the standard of living you expect in retirement. A good starting point is using the Retirement Living Standards tool from the Pensions and Lifetime Savings Association which outlines what you would need to fund a minimum, moderate and comfortable lifestyle. This will help you determine whether you’re on track to meet the savings required, and make any adjustments to your finances if not.”

|