Laura Suter, director of personal finance at AJ Bell, comments: “The decision to cut the Cash ISA allowance for those under the age of 65 is going to lead to bigger tax bills for the nation. While the government is hoping the move is going to nudge more people into taking their first steps into investing, in reality many people will just leave their money in non-ISA accounts and so pay tax on their savings interest.

“The Budget also saw the personal savings allowance frozen for another year and the tax rates for savings interest increased – leading to a triple blow for cash savers. Quite simply, they will see more of their money taxed at higher rates.

“AJ Bell research found that if the Cash ISA allowance was cut, most Cash ISA savers (51%) would simply stick the money in a taxable savings account. If they did this they would be landed with a juicy tax bill after a number of years. Someone who usually paid the full £20,000 into their Cash ISA, who was then limited to £12,000 from April 2027, would find themselves with £8,000 of cash looking for a home. If they popped it into a non-ISA cash account they’d face tax on their savings interest once they breach their personal savings allowance – while additional-rate taxpayers would pay tax on all their savings interest, as they get no tax-free savings allowance.

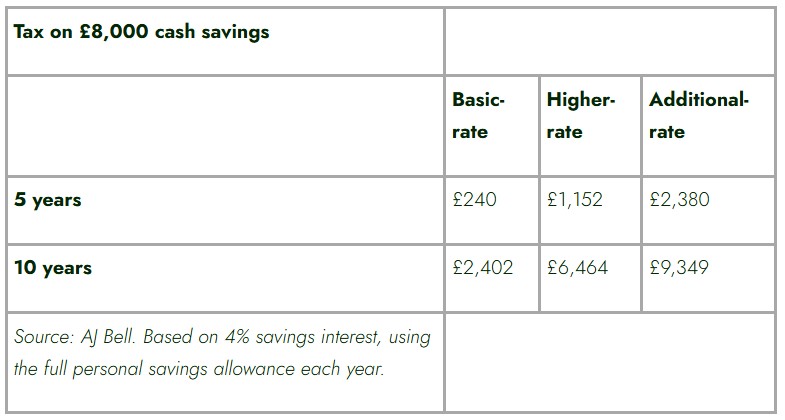

“If you look at one year alone, and assume 4% interest on the cash, it doesn’t represent a huge sum of interest: just £320. This means it’s covered by the personal savings allowance for both basic-rate and higher-rate taxpayers, assuming they have no other taxable savings, and lands additional-rate taxpayers with a £150 tax bill. But over a number of years the tax bill really adds up.

“Over five years the total bill for an additional-rate taxpayer is £2,380 and over 10 years it totals a whopping £9,349 extra in tax. Even a basic-rate taxpayer, who gets a £1,000 tax-free allowance each year for their savings interest, will see a £240 tax bill after five years and a chunky £2,402 bill over the 10 years.

“These figures lay bare the personal cost to individuals of the Budget changes. While it’s being badged up as trying to incentivise people to get into investing, in reality the move is also likely to be a huge cash cow for the government, as they rake in more tax on people’s savings. Interestingly in the Budget, the potential revenue generated from the Cash ISA changes was wrapped up with other Budget measures, meaning it's not clear how much the government expects to get in extra tax.”

How to beat the hike

“Savers looking down the barrel of a tax bill for their cash savings can look at other options to generate a return on their money before the April 2027 deadline hits. While the default may seem like a non-ISA cash savings account, there are other options to consider that could pay off in the long run.”

Premium Bonds

“In our survey, a quarter of people said that if the Cash ISA allowance was cut they would buy Premium Bonds or another NS&I product. The appeal of Premium Bonds has just increased dramatically for some people, as any winnings are tax-free. While there is obviously the chance you could win nothing, as there is no traditional interest paid on the accounts, you could win in the prize draw and those winnings will be tax-free.

“You can save up to £50,000 per person in Premium Bonds and currently based on the average chance of winning your average returns would be 3.6%. It’s less than the best rate you can get on traditional savings accounts, but for some the lure of winning big plus the tax-free prizes will be enough to attract their cash.”

Invest instead

“While the ISA allowance will be slashed for cash, it will remain at the full £20,000 for investments. We know that we’re a nation of cash lovers, and many people have more cash than they need. FCA data shows that since 2021 the number of people holding more than £10,000 in investible assets wholly or mainly in cash has risen from 8.4 million to 11.8 million.

“But savers should at least consider investing, to see if it’s right for them. Recent research from AJ Bell found that investing £1,000 each year since 1999 in the average IA Global sector would now be worth £92,349 versus just £36,290 in the average Cash ISA – a difference of £56,059. So those sticking to cash could be leaving themselves much poorer over the long term. That’s not to say that everyone should ditch cash: some people prefer the security of knowing their money is safe from market fluctuations, while others need a short-term home for their money or easy-access savings. But being in cash should be a conscious decision, rather than unthinkingly hoarding it.

“Investing for the first time can feel daunting. If you don’t feel confident picking which countries or sectors to invest in, you can defer asset allocation decisions to a professional. You can buy so-called ‘all in one’ funds that spread your money between different country’s stock markets and across various asset classes, with an option of having more or less in stock markets versus bonds, gold and cash, depending on your risk appetite. Alternatively, first-timers could buy a cheap ‘tracker’ fund, which mimics the performance of a broad global index, such as the MSCI World. Fidelity Index World is one option for this, which has a low annual cost of 0.12%.

“Investors also need to make sure they understand what they’re buying, and why they think it will make money – whether it’s a fund or a share. All too often investors are lured in by the promise of high returns or invest because a friend has recommended it, but you need to make sure you understand how the investment works and all the risks before you commit your money.”

Spend it

“When we quizzed people about what they’d do with their surplus cash if the ISA allowance was cut, 13% said they’d spend it and another 13% said they’d use it to pay down mortgage debt. While recklessly spending your hard-earned savings just because they may face tax clearly isn’t the smartest financial move, using the money could be smart. We know that lots of people have large cash savings, so if you have more cash than you need for an emergency pot and short-term spending needs, you should look at whether you could put it to good use.

“If you have expensive debt, it’s a good idea to pay that off before you think about investing the money or saving more. And if you have a mortgage you could use surplus savings to pay off a chunk – particularly if you’re facing higher interest rates on this debt now. Just remember that once you’ve overpaid your mortgage it’s tricky to get that money back, so make sure you won’t need to access that money later. Also weigh up the interest you’re paying on the debt vs the amount you could generate through investing. It’s a personal choice depending on your priorities.”

Tactically use fixed-rate accounts

“Fixed rate savings accounts can earn you higher interest, you just have to be willing to lock your money up for longer. You can choose the length depending on your needs, from one year up to five years or more. But it’s a good way to lock in a higher return than easy-access cash. The money will still be taxable if it’s not in an ISA, but you could be tactical with the accounts you choose.

“You only pay tax on the interest for most fixed-rate accounts at the end of the term, which means you could defer the tax hit to another tax year. For example, if you took out a one-year fixed rate account now, that paid out the interest at maturity, that would only factor into your 2026/27 tax year. It’s a smart move if you know you’re going to drop to a lower income tax bracket in a future year, which means you’d have a higher personal savings allowance and pay a lower tax rate on your savings. Equally it can be a good move if you’ve got lots of taxable savings this year, and so have already hit your tax-free limit, but may have less next year. It’s a good idea to track the savings accounts on a spreadsheet, so you don’t lose track of when they mature, or use a cash savings hub, so they are all in one place.”

|