Nearly one in 10 estates liable for inheritance tax (IHT) paid over £500,000 in the latest available year, with the number expected to rise from April 2027 when pensions are set to be included in IHT calculations, according to data obtained by Rathbones, one of the UK’s leading wealth and asset management firms.

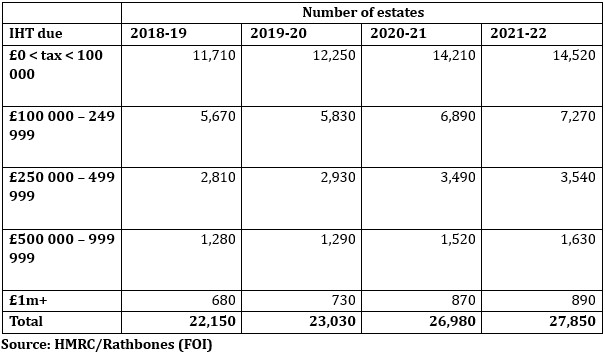

Of the 27,850 estates liable for IHT in the 2021/2022 tax year (the most recent figures available), 1,630 paid between £500,000 and £999,999 in IHT, while a further 890 estates paid over £1 million, data obtained in a Freedom of Information request by Rathbones shows. This totals over 2,520 estates, 9% of all estates in the same year liable for inheritance tax. This represents a 29% increase from the figure recorded at the end of the 2018/19 tax year – and the number is still rising.

If this trend continues, 3,524 estates could pay over £500,000 in IHT by the end of the current tax year 2025/26 (based on an average increase of 8.74% each year - this was the average annual increase between 2018-19 to 2021-22).

Rebecca Williams, Divisional Lead of Financial Planning at Rathbones, says: “More and more people will be caught out by IHT charges, despite the availability of gifting allowances and the seven-year rule. The deep freeze on both the main nil-rate band and the residence nil-rate band, unchanged since 2009 and 2017 respectively, has led to a creeping form of fiscal drag. As house prices and asset values have steadily risen, more estates are being brought into the IHT net simply because the thresholds haven’t kept pace with inflation.

“This issue is set to worsen from April 2027, when pension assets are brought into the fold and change could pull even modest estates into scope for IHT, making it increasingly vital for families to engage in effective financial planning. Without proactive steps, more estates will find themselves facing IHT bills they might not have anticipated.”

With pension assets set to be brought into the scope of IHT from April 2027, many more estates are expected to incur new or higher IHT charges before the end of the decade, putting greater pressure on those preparing for retirement or succession planning.

In 2021/22, approximately 39% of estates with an IHT liability paid between £100,000 and £499,999. Of these, 7,270 estates paid between £100,000 and £249,999, and 3,540 paid between £250,000 and £499,999. The majority of estates (52%) paid up to £100,000 in IHT.

Overall, there was a 26% increase in the number of estates paying IHT over the three years to the end of 2021/22, with more estates facing higher IHT bills.

Upcoming IHT changes put a third of savers off pension contributions

Additional research by Rathbones on the impact of the Government’s plans around IHT found that nearly one in three (31%) people with pensions say they are put off making further contributions to their pension pots by the changes, which means they lose the tax efficiencies of pension saving.

The money they are no longer contributing to their pensions is most likely to be put in cash – around two out of five (39%) questioned said they will deposit the money in savings accounts while 25% plan to invest some of the money in equity ISAs.

Almost one in seven (14%) questioned say they have already changed their focus to property investment as a result of the decision.

Desire among clients to help younger generations now

Rebecca Williams adds: “Parents and grandparents are increasingly aware of the IHT bill they might be leaving behind and many are looking for ways to support family and loved ones during their lifetimes instead. Conversations with clients show a real desire to help younger generations now – particularly with education and getting onto the property ladder – while safeguarding their own long term financial security, and these changes add an extra layer of complexity to wrestle with.

“The Bank of Mum and Dad is under pressure, clients are walking a line between supporting children today, having enough for later life care tomorrow and not wanting to give the Treasury too much of their hard-earned wealth on death.”

|