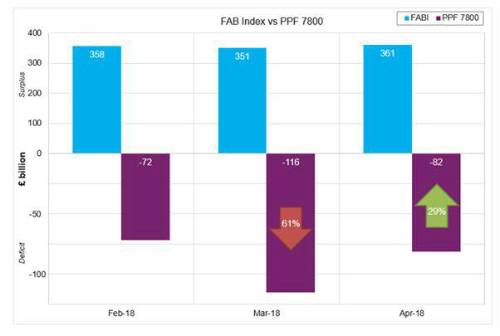

Earlier this month, the Pension Protection Fund (PPF) also announced a 29% improvement in the PPF 7800 Index deficit, from £116bn (93% funded) to £82bn (95% funded) at the end of April. This is close to its near 4-year record high of 97% funded from earlier this year.

First Actuarial Partner Rob Hammond said: “We are starting to see more stories of pension scheme surpluses hitting the news. Whilst it is important that these published surpluses are properly understood, the stable FAB Index and gradually improving PPF 7800 Index are good news pensions stories which should help to restore public confidence in pensions.”

Hammond added: “The PPF 7800 Index has continued to ‘yo-yo’ with the improvement seen in April following a deterioration in March, but we are getting closer to the funding ratio of the PPF 7800 Index hitting 100%, which would reflect a very healthy state for the UK’s pension schemes.

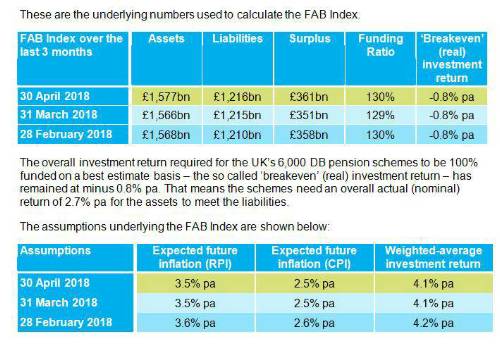

“The FAB Index indicates that the UK’s 6,000 defined benefit schemes currently have a best-estimate surplus of £361bn and a funding ratio of 130%. This is before the addition of future deficit recovery amounts which many schemes have already agreed, and indicates that schemes are generally funded on prudent bases. The latest pensions White Paper proposes asking schemes to demonstrate how prudent their funding bases are. The FAB Index suggests that there is plenty of prudence already in the system, with schemes collectively holding a 30% buffer to cover things moving against them.”

The technical bit…

Over the month to 30 April 2018, First Actuarial’s Best estimate (FAB) Index improved, with the surplus in the UK’s 6,000 defined benefit (DB) pension schemes increasing from £351bn to £361bn.

The deficit on the PPF 7800 Index improved by 29% over April from £115.6bn to £81.7bn.

|