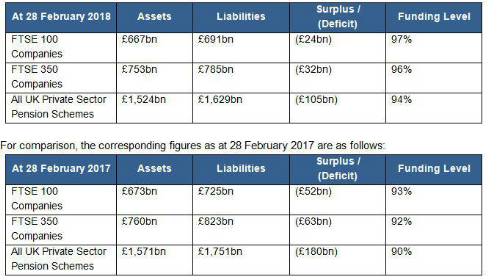

As at 28 February 2018, JLT estimates the total DB pension scheme funding position as follows:

Charles Cowling, Director, JLT Employee Benefits, comments: “Once again, markets have been reasonably benign for pension schemes this month and overall reported pension deficits have continued to drift downwards. However, this positive picture masks ongoing challenges for a number of companies with large pension schemes, evidenced this week by news that the Toys R Us pension scheme will soon be following Carillion’s scheme into the Pension Protection Fund (PPF).

“One of the key problems for many companies is that the pension deficit calculated by scheme trustees, which determines the cash funding required to be paid by the employer, is significantly greater than the pension deficit reported in the employer’s accounts.

“Moreover, actuarial valuations currently being conducted are likely to show a need for significant increases in cash funding. This will come as a difficult message for both schemes and sponsors, at a time when the tension between funding deficits and paying dividends to shareholders has already spilled over. Indeed, at the most recent Work and Pension Select Committee meeting on Carillion, chair Frank Field challenged the Pensions Regulator’s (tPR) current approach to companies intent on “shovelling money to shareholders”.

“We expect tPR to take a tougher stance on companies prioritising dividends to shareholders over contributions to pension schemes in its 2018 Annual Funding Statement. TPR has been reported to be seeking "improved" powers to impose a schedule of contributions on DB pension schemes in the Government's upcoming and much anticipated pensions white paper.

“The positive news we can take from the recent examples of Carillion and Toys R Us is that the UK system of protections established in 2005, and most significantly the introduction of the PPF, have collectively meant that members’ pensions are now much better protected than they were. Hard as it is to see a company and a pension scheme fail, the presence of the PPF means that trustees can sleep easier knowing that the very large majority of members’ pension benefits will be paid to members – even if a company fails.”

|