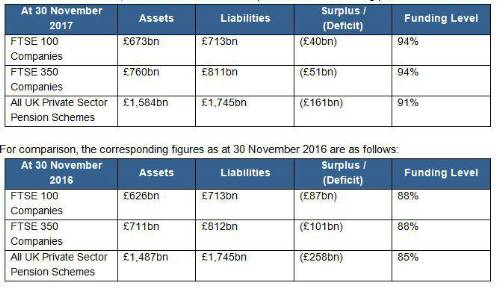

As at 30 November 2017, JLT estimates the total DB pension scheme funding position as follows:

Charles Cowling, Director, JLT Employee Benefits, comments: “Despite the first rise in interest rates for more than 10 years, November has been a quiet month for markets and pension schemes. The rate rise was widely anticipated and, with inflation showing no further signs of increasing and a fairly neutral Budget, markets have remained calm. This is despite concerns over the poor economic outlook and Brexit.

“After 10 years of painful reductions, rising interest rates will come as some relief for pension schemes as it will reduce the value attached to their liabilities. Further relief may also be coming as improvements in longevity continue to slow, which would likely reduce pension liabilities. Consequently, finance directors may see their year-end numbers looking more positive than expected earlier in the year.

“However, many challenges still remain. Pension schemes which are carrying out actuarial valuations in 2017 are likely to show much bigger deficits than at their last valuation in 2014. Finance directors will therefore be facing trustees asking for higher contributions.

“Moreover, for the few private sector schemes still left providing Defined Benefit (DB) pensions to employees, the 2017 actuarial valuations will be showing much higher ongoing pension costs than 2014. The pressure will again be on private sector employers to find alternatives to DB pensions.

“The public sector seems to live in a parallel world when it comes to assessing their DB pension costs. This has been amply illustrated this month by news around USS, the UK’s largest private sector pension scheme, as proposals to close it to new DB benefits and move university staff over to a DC pension prompted the University and College Union to send out ballot papers this week to all university staff calling for strike action in the New Year.

“But, for now, trustees and finance directors may wish to take advantage of these slightly calmer waters to explore opportunities to offload and settle pension liabilities.”

|