|

|

JLT Employee Benefits (JLT) has updated its monthly index, showing the funding position of all UK private sector defined benefit (DB) pension chemes under the standard accounting measure (IAS19) used in company reports and accounts. |

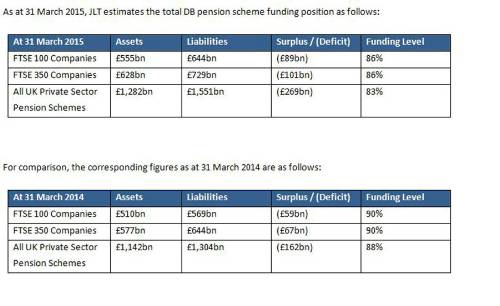

As at 31 March 2015, JLT estimates the total DB pension scheme funding position as follows:

Charles Cowling, Director, JLT Employee Benefits, comments:

“As the General Election campaign gets underway, the increase in the total deficit in UK private sector pension schemes of over £100billion in the last 12 months is a sober reminder of the burden that besets UK pension schemes. Low and even negative interest rates continue to give rise to ever bigger deficits and could prove particularly problematic for pension schemes with actuarial valuations in 2015 – demands from pension scheme trustees for more cash payments into DB pensions could escalate significantly in 2015.

“There has been much radical overhaul of pensions legislation in the UK in the last few years, partly as politicians of all colours are all too aware of the importance of the grey vote. Indeed some of the most radical change in pension regulations in decades comes into force next week, with members of DC schemes able to cash out their pension funds in full. However, the new ‘freedom’ has not materialised in the same way for DB scheme members as their ability to access funds by transferring them into a DC scheme seems to be getting ever more bogged down in red tape. Likewise, DB schemes looking to transfer liabilities to individual members are facing the same headwind.

“This is the result of the authorities getting increasingly worried about individuals making potentially inappropriate investment decisions for themselves, albeit there is considerable nervousness, with some justification, over the possibility of a big increase in pension scams as well.

“So far there haven’t been any proposals or policies put forward by the political parties that look likely to alleviate the pressure on DB pension schemes. But maybe with 37 days to go until 7 May, there is still time?”

|

|

|

|

| Senior Pricing & Portfolio Management... | ||

| London - £150,000 Per Annum | ||

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.