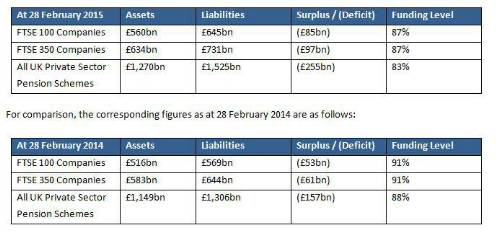

As at 28 February 2015, JLT estimates the total DB pension scheme funding position as follows:

Charles Cowling, Director, JLT Employee Benefits, comments: “The Alice in Wonderland world of negative interest rates seems to be expanding, spreading from Switzerland right across the Eurozone. In the last few weeks Germany, France and Finland have all been able to sell negative yielding debt with terms of up to 5 years. This in turn is putting huge pressure on insurance companies and pension schemes with fixed liabilities and ever fewer opportunities for generating the levels of low-risk investment returns that are needed to meet these liabilities.

“As a consequence the burden of growing pension deficits is increasingly visible in the accounts of companies with large DB pension schemes. Across all UK DB pension schemes, the total deficit (on the IAS19 accounting basis) has grown in the last 12 months by £100bn to over £250bn.

“The even lower interest rates we now see in the UK could prove particularly problematic for pension schemes with actuarial valuations in 2015 – typically the actuarial valuation takes place every 3 years and this is when decisions are made on deficit funding. Demands from pension scheme trustees for more cash payments into DB pensions look set for significant escalation in 2015.”

|