|

|

JLT Employee Benefits has updated its monthly index, showing the funding position of all UK private sector defined benefit (DB) pension schemes under the standard accounting measure (IAS19) used in company reports and accounts. |

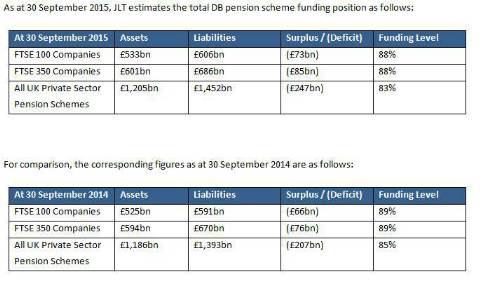

As at 30 September 2015, JLT estimates the total DB pension scheme funding position as follows:

Charles Cowling, Director, JLT Employee Benefits, comments: “The Fed’s decision to keep interest rates at rock-bottom level for longer has done little to relieve the markets from severe volatility, squashing pension schemes’ hopes that deficits will reduce soon.

“Indeed, there are plenty of reasons to worry about the global economic growth. In Europe, Greece is still in dire straits, even if Tsipras’s decisive win at the general election should provide more political stability and reassurance that the reform plans will be delivered. Meanwhile, China, the world’s second economic power, continues to struggle to stay on the path to greater market liberalisation.

“It is not surprising therefore to see the latest figures on the pension deficits within UK Private Sector Schemes jumping by £40bn from £207bn a year ago to £247bn. This highlights the continuing challenge of managing DB pension risks and deficits in the UK. With just under half of DB pension assets still invested in equities, pension schemes are exposed to a huge amount of market volatility, potentially leading to big losses that can further widen the deficit gap.

“Companies and trustees should continually be on the lookout for ways to reduce pension risk and explore any opportunity to de-risk their pension scheme. Some pension schemes have indeed made great efforts to reduce their pension risks and have been rewarded with lower deficits and less volatile balance sheets – Smiths Group, which announced its latest results last week highlighting a lower pension deficit, is one such example. Other companies would do well to follow their lead.”

|

|

|

|

| Senior Pricing & Portfolio Management... | ||

| London - £150,000 Per Annum | ||

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.