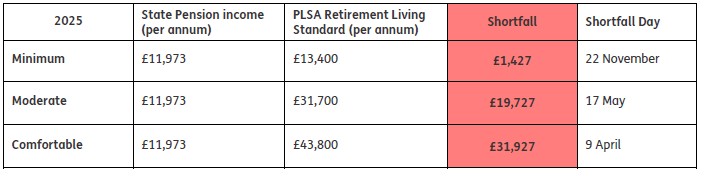

This weekend, 22 November, marks State Pension Shortfall Day – the day in 2025 when a single pensioner on the ‘minimum’ of the PLSA Retirement Living Standards would have exhausted the full new State Pension (£11,973 in 2025-26) and be reliant on private pension income or other savings to bridge the gap.

A single pensioner requires annual income of £13,400 to achieve the ‘minimum’ of the PLSA’s Retirement Living Standards. Spreading both the full new State Pension and this ‘minimum’ expenditure evenly across a twelve-month period leaves a shortfall of £1,427 a year with the State Pension running out on 22 November.

Pensioners aspiring to the ‘moderate’ or ‘comfortable’ Retirement Living Standards will need to save significantly more to generate the income to fund expenditure of £19,727 and £31,927 a year, respectively. Those who only have retirement income from the full new State Pension would face running out of money much earlier in the year if their spending was aligned with these two higher Retirement Living Standards.

The PLSA defines the ‘minimum’ Retirement Living Standard as covering all of a pensioner’s needs, with some left over for fun and social occasions, including a one week holiday in the UK, eating out about once a month and some affordable leisure activities about twice a week.

Stephen Lowe, group communications director at Just Group, commented: “In a year in which the Government launched both a State Pension Age Review and a Commission to consider pensions adequacy, Saturday 22 November marks the day in the year when a single pensioner living to a ‘minimum’ standard of living would theoretically run out of money if their only source of retirement income was the State Pension. The State Pension has seen significant increases in recent years and provides a solid foundation of income in later-life which, as this research shows, is likely to cover the majority of retirees’ essential spending. However, it is clear that people will need to hold a substantial amount in pensions or other savings to top up the State Pension in order to achieve the lifestyle in retirement many may want.”

|