If there is truth in the saying “failing to plan is planning to fail”, new research from retirement specialist Just Group raises concerns about the lack of formal retirement planning among the millions heading towards the end of their working lives.

The in-depth look at the attitudes and experiences of the Gen X and Baby Boom generations – part of Just Group’s GenVoices programme – reveals that only a minority have more than a vague plan for their life after work.

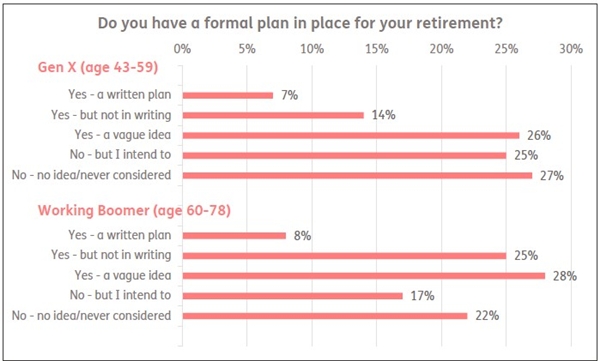

Among Gen X workers (born between 1965-1983) only 6% had a written plan for retirement while 13% said they had a plan but not in writing. For working Baby Boomers (born between 1946-1964) only 7% had a written plan and a further 22% said they had a plan but not in writing.

Around a quarter of each cohort – 24% of Gen X and 26% of working Boomers – said they had “a vague idea”. About 24% of Gen X and 15% of working Boomers do intend to make a plan. However, the largest response among all groups was that they had no plan or had not considered a plan.

Stephen Lowe, group communications director at Just Group, said: “Retirement is looming for both cohorts but our research shows the vast majority have not made a formal plan for how they want to retire, risking reaching retirement unprepared. The most obvious issue for these groups is that time is running out for them to put money into pensions and other investments for retirement, but that assumes they can continue to work until State Pension age or later. For people who are forced out of work early, perhaps due to illness or redundancy, they may find their retirements undermined before they even begin.”

He said that retirement planning ideally needs to start when people are in their 40s, giving more time for people to adjust their lifestyles to achieve the retirements they would like.

“There are resources available to help people create a smooth glide path into retirement,” he said. “It is important to keep on top of key information such as the value of your own pensions and the amount of State Pension you will receive and at what age.

“Services such as the government’s free online ‘midlife MOT’ are available to help people gauge their progress in terms of savings, pensions, debt as well as work and health. And for those considering accessing a defined contribution pension there is also the free, independent and impartial Pension Wise service. Many pension schemes offer ‘retirement readiness’ calculators or sophisticated planning services that help members envisage their future and how to achieve it. A regulated adviser can also help you set your objectives and recommend ways to achieve them, providing a written plan that is reviewed regularly to ensure it remains on track.”

|