The rise in car insurance prices also means this is the most expensive average for car insurance since Q4 2020, when a typical policy cost £724. The Association of British Insurers has stated that higher premiums are a result of increased cost pressures, including an uplift in the value of second-hand cars, a growing accident rate since the end of pandemic travel curbs, and repair cost inflation.

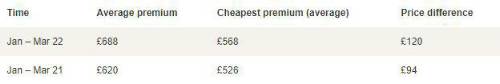

Cheapest quoted premiums have also increased to £568 from £526 – a £42 upswing year-on-year. This widening gap between the cheapest and average premium means greater savings are now available to motorists who switch insurers. Drivers could save an average of £120 by shopping around for the cheapest deal.

Young motorists could benefit from the biggest savings by switching car insurance. The average premium for drivers under 25 stands at £1,225 - £163 more than in the same three months in 2021. However, if young drivers shop around for the cheapest deal when their policies come up for renewal, they could typically save £257 by switching.

Alex Hasty, Director at comparethemarket.com, said: "Drivers will be disappointed that motor premiums are less affordable than in previous years as household budgets continue to be impacted by rising fuel and energy costs. Insurance prices began to increase rapidly at the end of last year and premiums have remained high in the first three months of 2022. This is concerning as lots of motorists are already struggling with the cost of driving.

"Switching to a cheaper deal continues to be one of the best ways to cut the cost of car insurance, with our research showing drivers could save an average of £120. Shopping around when your policy comes up for renewal can significantly benefit young motorists who face the biggest increase in premiums. Drivers below the age of 25 could save a substantial £257 by switching. These savings could help to offset rising petrol costs or household bills."

|