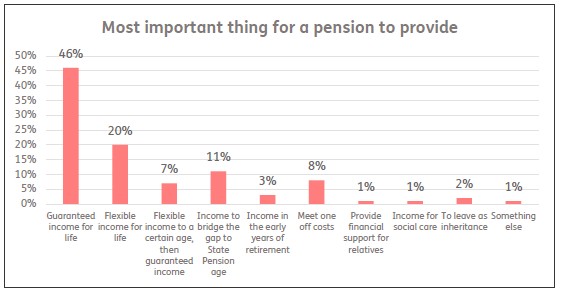

The survey of 40-75 year-olds with a Defined Contribution (DC) pension shows that nearly half (46%) consider guaranteed income to be the most important thing they want their pension to provide. This is substantially higher among both the youngest pre-retirees (58% of those aged 40-44 and 50% of those aged 45-49) as well as the oldest (51% of those aged 70-75).

Among 40-75 year olds with DC pensions, 7% want flexible income up to a certain age and guaranteed income after that point, illustrating that the majority of adults value guaranteed income, whether that is to cover essential spending or to provide a straightforward way to manage their money later in retirement.

Only a fifth (20%) of all respondents said that flexible income was the most important factor and 11% said they were primarily looking to their DC pension to provide a bridge until they reach State Pension age. 2024 recorded the highest demand for guaranteed income for life solutions since the introduction of pension freedoms; the ABI reported2 £7bn of annuities were purchased last year, an increase of more than a third (34%) compared to 2023.

Stephen Lowe, group communications director at Just Group, said: “In a volatile and turbulent world, this data highlights a strong appetite for financial certainty and peace of mind in retirement. Younger savers seem to be particularly attracted to guaranteed income, challenging the assumption that flexible access to pension cash through drawdown is the preferred route. The rise in annuity rates has increased demand for guaranteed income but there are also innovative products being introduced that blend drawdown and annuity, which is also increasing interest. This allows people to rest easy knowing that they have sufficient income to cover their essentials and can still invest their remaining capital for growth if they choose. There has never been a better time to explore guaranteed income for life given the strong rates available. More people are choosing to shop around and a competitive market is providing an increasing range of tailored solutions.”

|