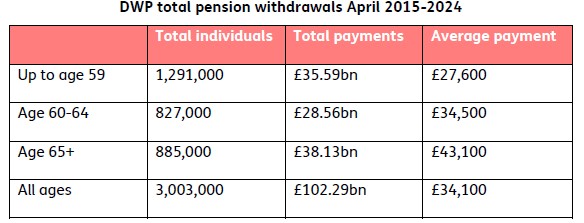

Seven in 10 of the 3 million pension savers who have taken flexible payments since the 2015 ‘pension freedom’ rule changes were below the age of 65, raising questions about whether people are tapping into pensions too early in retirement.

Figures from the Department for Work and Pensions – which don’t include tax-free cash withdrawals potentially running into billions – show that almost 43% of all flexible payments were made to those aged under 60, with nearly 28% more aged between 60-64.

Of the £103 billion taken as flexible payments since 2015, £36bn (35%) was paid to those aged below 60 and nearly £29bn (28%) to those aged between 60-64.

Just Group said the figures show the huge scale of withdrawal from pensions long before State Pension age, a trend previously described by the Financial Conduct Authority as ‘the new norm’.

Group communications director, Stephen Lowe, Just Group said: “Perhaps if the FCA had called it an ‘epidemic’ it might be viewed in a different light and more steps taken to understand the consequences. Pension flexibility is double-edged – it can be done for good or bad reasons. Ultimately pensions are primarily to provide retirement income and that money won’t be available in old age if people are using it to subsidise their lifestyle long before retirement.

“Overall, these numbers give a glimpse of one aspect of pension withdrawal, but do not show the full extent of early access in terms of the number of individuals taking cash and the amounts they are withdrawing. The normal minimum pension age will increase to 57 in April 2028 from 55 currently, a sign that the government sees a risk in giving access to pension money too early. Honestly, there is a massive blind spot in our knowledge,. We don’t know how much tax-free cash is being taken. We don’t know why people are accessing pensions early or what they are doing with the money. We have some pot-level data but much weaker data at a person-level, considering all their pensions and other assets. The result is that we can’t tell how many accessing cash early are doing it for savvy financial planning reasons compared to how many are taking unsustainable amounts that will likely leave them short in the future.

He said that anyone thinking of taking pension cash early should take steps to understand their options fully and the longer-term consequences of their actions. Professional advice can help people think about the future while those approaching retirement should take the free, independent and impartial guidance offered by Pension Wise which gives a good overview about financial decisions for later life.

|