|

|

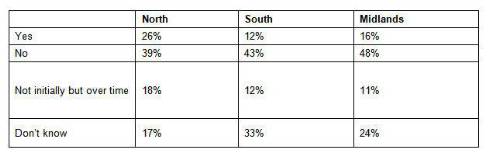

With thousands of SMEs across the country introducing workplace pensions as a result of automatic enrolment, new research* from NOW: Pensions has found that those in the North have won the postcode lottery when it comes to generous employer contributions. Of the 400 small and medium sized companies surveyed, just 12% of those in the South said they are planning on paying more than the minimum auto enrolment contribution for employees, compared to over a quarter (26%) of firms in the North and 16% of those in the Midlands. |

The North also lucks out on employers most likely to increase their contribution, with 18% of firms saying they plan to pay the minimum initially, with a view to increasing their contribution over time. The South is unlucky again, with only 12% intending to increase their contributions, as are the Midlands, with only 11% of firms planning to up their payments.

Thinking about auto enrolment at your company, do you intend to pay more than the minimum employer contribution?

Compared to similar research** conducted by NOW: Pensions last year, the country has been turned on its head with regard to generosity of employer contributions. Last year the South came out on top with 11% of firms planning to pay in more than the minimum contribution, whilst in the North only 5% of employers intended to contribute more, and only 6% in the Midlands.

The main reason for this increase in intention to pay more than the minimum in the North is down to the fact that 66% of employers in the region believe that contributing more than the minimum will directly help with the recruitment and retention of employees. Two out of five (41%) believe that by contributing more than the minimum, they will encourage employees to do the same. Across the board, in all three regions, more than a third (39%) believe that the minimum employer contribution has been set too low for a comfortable retirement.

Morten Nilsson, CEO, NOW: Pensions said:

“It’s good to see employers recognising that if they put more money into their employees’ pensions, it could make working for their business a more attractive prospect.

“The reality is that even when auto enrolment is fully rolled out, a combined pension contribution of 8% still isn’t going to be enough for most people. Contributing even a small amount more than they are obliged to do can mean the difference between a frugal or comfortable retirement for their employees.”

|

|

|

|

| Senior Pricing & Portfolio Management... | ||

| London - £150,000 Per Annum | ||

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.