Analysis from Equiniti finds that income taken from occupational pension schemes has seen a substantial increase in its importance to the nation’s retirement finances.

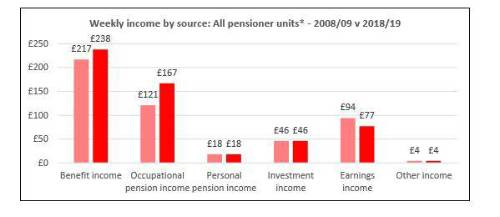

In the decade between 2008/09 and 2018/19, occupational pension income rose from £121 to £167 a week, an increase of 38%. It now accounts for nearly a third (30%) of the total average income of all pensioner units* which stands at £550 a week, or around £28,600 annually. In 2008/09, occupational pensions provided just 24% of the £500 average weekly income for retirees.

The only other source of income to see an increase was State Benefits which rose 10% from £217 to £238 per week over the same period and represents 43% of pensioner income. All other income types remained flat except earnings income which decreased to £77 a week.

The research follows figures released by the DWP which found that the number of employees putting more than 7% of their pensionable pay into a workplace scheme had more than doubled to 1.6 million people between 2011 and 2018.

Duncan Watson, CEO of Equiniti’s pension business, believes the figures demonstrate the success occupational pensions have been in helping retirees meet the growing responsibility they shoulder in funding their later-lives. He also urges younger employees to see the value in continuing contributions to their workplace pension scheme even in the current exceptional circumstances.

“Occupational pension income is the most rapidly growing source of funds for pensioners and is catching up income provided by the State as the most valuable in retirement,” said Duncan Watson.

“Many people may currently see their incomes stretched if they have been placed on furlough or are facing other financial difficulties as a result of the crisis. However, our fear would be that if a large swathe of employees seek to dip out of pension contributions for a short while it could harm positive behavioural attitudes that have become the norm since the introduction of auto-enrolment.

“Added to this, those who continue to invest as the market suffers from continued turbulence could benefit from upside as the world recovers from this unprecedented crisis and moves towards greater certainty.”

* A “pensioner unit” is defined as single pensioners over State Pension age or pensioner couples with two adults married or living together where one or more is over State Pension age.

|