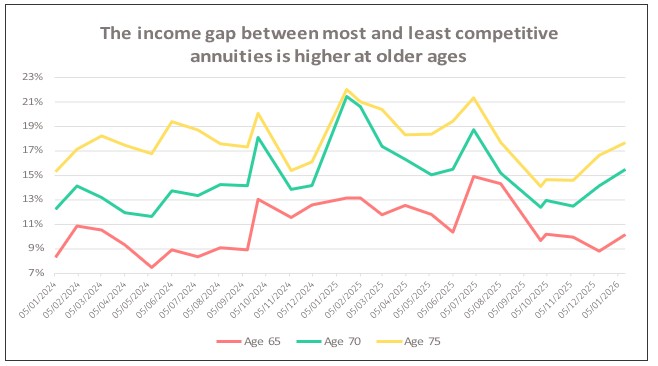

The gap between the most and least competitive provider of Guaranteed Income for Life rises from about 10% at age 65 to nearly 18% at age 75, new analysis by retirement specialist Just Group shows. With a £50,000 pension pot, a 65-year-old would receive about £355 a year more income by choosing the best rate available over the worst, while a 75-year-old would receive £717 a year more income from the best rate. The difference adds up to thousands of pounds over the course of a long retirement.

Just Group said its analysis of current rates found that the gap between the best and worst deals is much higher at age 75 than at age 70 or 65, reinforcing the need for older buyers to compare providers before handing over their pension money.

In cash terms, a healthy 75-year-old buying an annuity with a £50,000 pension could expect about £4,780 income each year for the rest of their life from the most competitive provider compared to £4,063 from the least competitive, a difference of £717 or 18% more income every year. The chart shows that this gap has been as high as 22% in recent months. At age 70 the best-worst difference is £564 or 15% extra income a year, while at age 65 the difference is £355 or 10% extra income per year.

David Cooper, director at retirement specialist Just Group, said: “Shopping around for the best deal is important at all ages but becomes increasingly important for those buying later in life because of the huge gap between the best and worst rates available. Demand for Guaranteed Income for Life solutions has risen sharply for the last few years as annuity rates have improved, but only those comparing between providers and being prepared to switch will reap the full benefits.”

He said that it was important people realised that there are no second chances for annuity buyers –

you have one chance to get the best deal.

“That means disclosing health and lifestyle information so that the rate offered is personalised to your circumstances, then taking that information into the open market to see which providers are the most competitive. The better the deal, the more income you will enjoy for the rest of your life.”

He recommends all retirees should take the free, independent and impartial guidance from the government-backed Pension Wise service. Professional annuity brokers or financial advisers can help choose options and compare between providers.

|