Under current law, the state pension age will rise from 66 to 67 by April 2028, and then to 68 between 2044 and 2046. However, the government could bring this change forward as part of a newly announced review into the state pension age, which will assess whether the current age threshold remains appropriate in light of increasing life expectancy, rising public spending and a growing population.

Independent state pension age reviews are legislated to take place every six years. The last independent state pension review, conducted by Baroness Neville-Rolfe and published in 2023, reaffirmed a commitment to a principle that at least ten years' notice should be given of any increase in the state pension age.

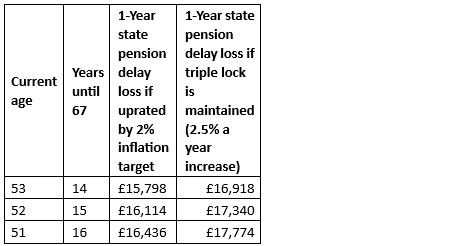

As such, if the state pension age rise to 68 is accelerated to 2039-41 instead of 2044-2046 following the review - due to conclude in 2029 - it could mean a loss of one year's full state pension payments: totalling £16,436 for workers aged 51, £16,114 for those aged 52 and £15,798 for those aged 53.

Rathbones’ calculations are based on the new full state pension of £230.25 per week (£11,973 annually) and assume 2% inflation per year thereafter - the Bank of England’s target inflation rate.

Under the state pension triple-lock guarantee (which guarantees at least a 2.5 % annual increase), those figures would rise to approximately £17,774 for workers aged 51, £17,340 for those aged 52 and £16,918 for those aged 53.

However, questions have been raised over the long-term affordability of the triple lock – which guarantees that the state pension rises each year in line with either inflation, wage increases or 2.5% - with the Institute for Fiscal Studies recently warning it could cost up to £40 billion a year by 2050.

Source: Rathbones. Based on the new full state pension of £230.25 per week (£11,973 annually) and inflation target (2%) vs triple lock (2.5% minimum triple lock guarantee).

Rebecca Williams, Divisional Lead of Financial Planning at Rathbones, says: “With longevity increasing and population pressures mounting, future generations appear set to face a less generous state pension regime than that enjoyed by many of today’s retirees. The situation appears particularly precarious for those in their early 50s who face real prospect of missing out.

“We’ve seen a number of people in their late 40s and early 50s come to us seeking greater clarity on their retirement prospects. With shifting goalposts in the pension landscape, many are understandably keen to ensure they’re on track to retire comfortably and on their own terms.

“The state pension alone is not enough for a comfortable retirement. Individuals need a broad foundation built on workplace pensions, private savings, and the ongoing support of pension tax relief. Cracks are beginning to show in the system, and they must be addressed urgently if we are to maintain faith in the UK’s pension framework and ensure people are equipped not just to survive, but to thrive in later life.”

Battle against pensions inadequacy as government revives Pensions Commission

The Department for Work and Pensions (DWP) is reviving the Pensions Commission, which first reported nearly 20 years ago, to explore ways to tackle the growing issue of pensions inadequacy.

Charlotte Kennedy, Chartered Financial Planner at Rathbones, says: “With pension arrangements offering a guaranteed income for life going the way of the dodo, the onus is increasingly on individuals to accumulate a nest egg that enables them not just to survive, but to thrive in retirement - with sufficient resources set aside to cover the cost of care. We find many people really value a helping hand from an expert to help make sense of their options and build a clear plan for retirement.

“While auto-enrolment has helped many build retirement savings with minimal friction, most savers remain far behind what is needed for a comfortable retirement.

“Efforts to bolster pension adequacy are welcome, but it’s important that new measures address the complex barriers preventing people from saving enough. The self-employed must not be left out. For business owners, pensions often take a back seat to the demands of growing a business.

“Financial education is also essential. It remains a minor part of the curriculum, typically folded into maths or PSHE. This must change. The earlier young people learn how pensions work, the more likely they are to start saving early and feel empowered to make informed financial decisions.”

|