The State Pension forms the bedrock to most peoples’ income in retirement, but doubts about its future is one of the biggest uncertainties shaping how the UK is preparing for retirement, according to new research from Standard Life’s 2025 Retirement Voice report. A third of Brits (33%) expect the State Pension age will reach at least 70 by 2030, and only half (51%) think the State Pension will be available for everyone when they retire, as it is currently.

September’s inflation figure of 3.8% confirms that the State Pension is set to rise by 4.8% under the Triple Lock - to £12,547.60 per year for the 2026–27 tax year - but with the total annual cost of the State Pension likely to increase by around £7 billion to £152.6 billion, doubts about its long-term sustainability are fuelling public anxiety. According to the data, less than a third (29%) of Brits think the Triple Lock will still be in place when they reach retirement, with Gen X among the most sceptical – just one in five (21%) expect it to remain intact.

Misconceptions around the current State Pension age also exist. While it currently stands at 66, fewer than one in five (18%) correctly identify this, dropping to just 14% of Gen X and 13% of Gen Z. Furthermore, while the State Pension age is currently due to increase to 67 between 2026 and 2028, and again to 68 between 2044 and 2046, a third (36%) believe it is already 67. Worryingly, almost one in ten (8%) think it is still the age of 60, rising to one in five (19%) of Gen Z.

Rising State Pension age and regional inequality

From April 2026, the State Pension age will begin to rise to 67, however this change won’t impact all regions equally, partly due to significant differences in life expectancy across the UK. Standard Life analysis of ONS longevity data reveals that people in some areas will receive State Pension payments for far fewer years than other regions.

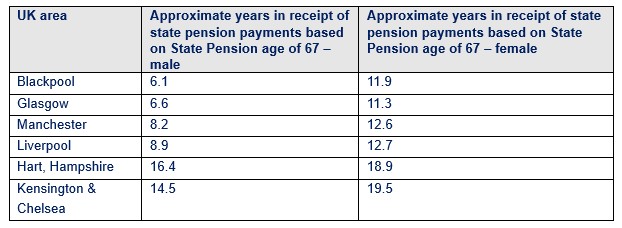

Men in Blackpool, for example, can expect approximately 6.1 years of State Pension payments on average, compared to 14.5 years for men in Kensington and Chelsea. Women in Blackpool can expect approximately 11.9 years of payments, compared to 19.5 years for women in Kensington and Chelsea.

Approximate number of years in receipt of State Pension by UK area, based on ONS longevity figures:

Private pensions are not plugging the pension gap

While confidence in the State Pension is eroding, the data also shows that private pension saving is far from bridging this gap, with just 15% prioritise pensions savings and almost one in five (17%) saying they don’t have a pension.

Furthermore, just over half (53%) of Brits worry that they’re not saving enough now for when they’re older (up from 51% in 2024) and almost half (47%) feel their retirement finances are outside their control. A growing number (50%, up from 46% in 2024) also expect to work beyond State Pension age – potentially reflecting a lack of confidence that the system will support them.

Catherine Foot, Director of the Standard Life Centre for the Future of Retirement, commented: “Standard Life’s Retirement Voice 2025 report shows just how uncertain people feel about their financial futures, with confidence in the future of the State Pension especially low. Many doubt whether it will exist in its current form by the time they retire, even though there is no indication from policymakers that such a change is likely.

“While raising the State Pension age further and faster than currently planned would impact everyone, it’s clear that the impact wouldn’t be felt equally, given the wide variations we see in life expectancy across the country. What’s more, in some parts of the UK, people are more likely to stop working earlier due to health conditions, disabilities or caring responsibilities - meaning they may struggle to reach the age at which the benefit becomes available. These structural inequalities deserve close attention in the current Independent Review of the State Pension Age and future policy debates that follow it.

“The revival of the independent Pensions Commission is an opportunity to take a fresh look at how the whole pensions system can adapt to longer working lives and shifting demographics. Two decades ago, the Commission reshaped retirement saving through auto-enrolment; today, we need similarly bold thinking to ensure the State Pension is considered alongside private pension provision and remains both sustainable and fair. Creating a retirement system that is equitable, adaptable and trusted will take coordinated action across government, employers, the pensions industry and individuals themselves. The good news is that we now have the chance to do that – and rebuild confidence in retirement for the decades ahead.”

|