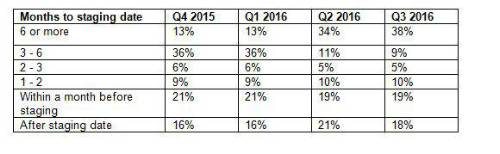

Of the employers who left it late, 19% contacted NOW: Pensions within a month of their staging date whilst 18% left it until after their staging date had passed.

At the other end of the spectrum, only 9% of firms left a clear three to six months ahead of their staging date, whilst 5% signed up two to three months in advance. One in 10 (10%) left it until one to two months ahead of the deadline.

*Percentages subject to rounding

Morten Nilsson, CEO of NOW: Pensions said: “It’s encouraging to see that so many small firms are taking their auto enrolment duties seriously and planning well in advance. The messages from the regulator are clearly getting through. But, at the other end of the spectrum, a lot of firms are still burying their heads in the sand.

Small business owners have a lot to think about and it’s easy for auto enrolment to be put on the back burner, but the fines for non-compliance are steep and missing the deadline can cause unnecessary sleepless nights.

Auto enrolment is complicated so the longer firms leave to tackle it, the more confident and comfortable they’ll feel.”

|