New Standard Life analysis shows that working just two days a week on the new National Living Wage is enough to kick-start pension savings through auto-enrolment

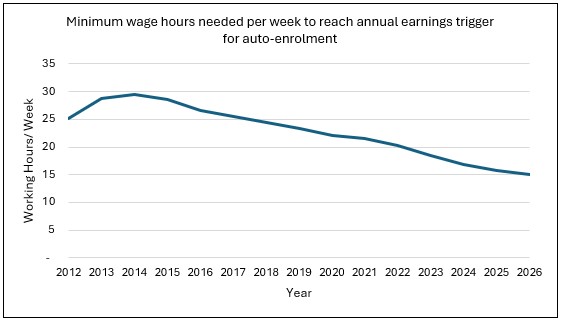

When the government’s landmark auto-enrolment pension policy was introduced in 2012, the National Minimum Wage (NMW) for people aged 21 and over was £6.19 per hour, and the annual earnings trigger for auto-enrolment was £8,105. This meant employees needed to work around 25 hours per week across the year to qualify for their employer’s pension scheme, as long as they were aged 22 and over.

Since then, increases in the minimum wage have outpaced rises in the auto-enrolment earnings threshold. The government has confirmed the National Living Wage (NLW) for people aged 21 and over is set to rise to £12.71 from April 2026, while the annual earnings trigger has remained fixed at £10,000 since 2014.

So employees aged 22 and over now qualify for auto-enrolment working just 15 hours per week (around two working days) across the year, ten hours fewer than when the policy was first introduced.

Standard Life analysis of National Minimum Wage statistics and AE Earnings Thresholds

Retirement saving on low incomes

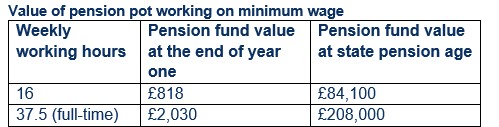

For many low-income and part-time workers, saving for retirement remains a considerable challenge alongside more immediate financial pressures. Recent research from Standard Life found just 9% of low-income households see pension saving as a financial priority over the next year, compared to 28% of high-income households. However, while long-term saving might not be a priority, even part-time work can result in meaningful contributions toward retirement savings. An employee earning the current minimum wage and working just 15 hours per week could add £818 to their pension pot through auto-enrolment in one year. Personal contributions benefit from tax relief and valuable employer contributions.

For those working full-time (37.5 hours per week), around £2,030 could be added to the pension pot in one year. Over a working lifetime, a 22-year-old employee working full time on minimum wage could build a pension pot worth up to £208,000, in today’s money terms, by state pension age.

Analysis: employee is aged 22 working on minimum wage, 3.50%/yr earnings growth, 5%/yr investment growth less charges. Fund value accounts for 2% inflation. The figures are an illustration and are not guaranteed. Earning limits not applied.

One of the key objectives of the recently reinstated Pension Commission is to tackle retirement savings adequacy among vulnerable groups, particularly low earners who are among the least likely to contribute to a pension. Currently, only one in four low-income private sector workers are saving for retirement. To address this, the Commission is expected to consider reforms to auto-enrolment, including lowering the age threshold for eligibility and removing minimum earning limits. These changes should broaden the accessibility of auto-enrolment and offer some additional boost to pension pots.

Catherine Foot, Director of the Standard Life Centre for the Future of Retirement, comments: “A rising minimum wage not only boosts pension savings through higher contributions on increased salaries, but it also makes auto-enrolment more accessible. With the new National Living Wage from April, working just 15 hours a week will be enough to meet the £10,000 annual earnings threshold, enabling more people to qualify for workplace pensions and start building their retirement savings.”

“Although cost-of-living pressures and immediate financial concerns remain a priority for low-income and part-time workers, even a small amount saved to a workplace pension, which is boosted by valuable employer contributions, can make a meaningful difference to future retirement incomes. The Pension Commission will need to strike the right balance between addressing under saving among the most vulnerable groups with the pressures facing employers with the rising cost of employment.”

|