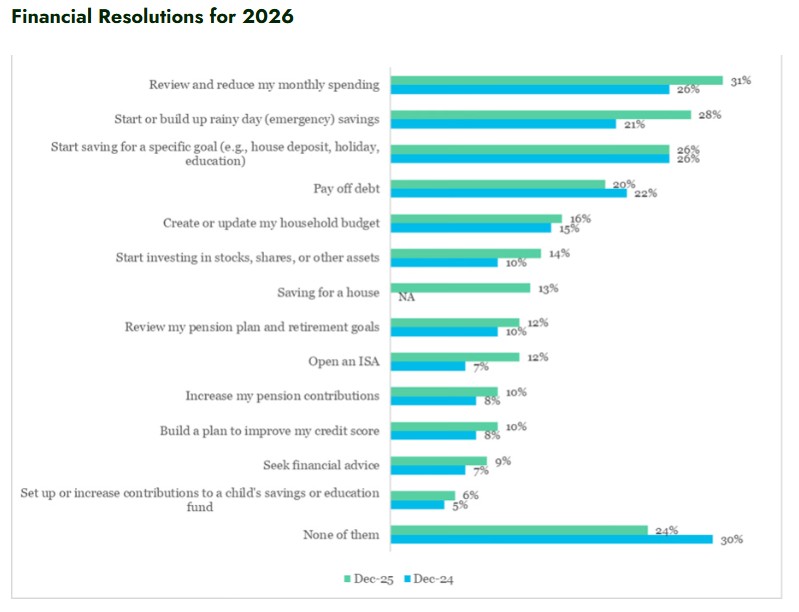

In its latest research, Pensions UK asked working adults about their financial New Year’s resolutions for 2026. The findings reveal that reviewing and reducing monthly spending remains the most common goal, rising to 31% from 26% last year. Building up rainy day savings has also grown in importance, with 28% planning to do so compared to 21% in 2025. Younger savers under 35 are leading the way, with 31% prioritising emergency funds compared to 24% among those aged 55 and over.

Saving for specific goals such as a housing deposit, holiday or education also remains important, with 26% planning to do so, and paying off debt continues to be a priority for one in five (20%), particularly those on average household incomes (£28k–£48k), where 23% are focused on reducing debt.

Beyond these essentials, more people are looking to grow their wealth through investment, with 12% planning to open an ISA (up from 7% last year) and 14% intending to invest in stocks, shares or other assets (up from 10%), highlighting a growing appetite for long-term financial growth.

Pensions: A significant shift in contribution intentions

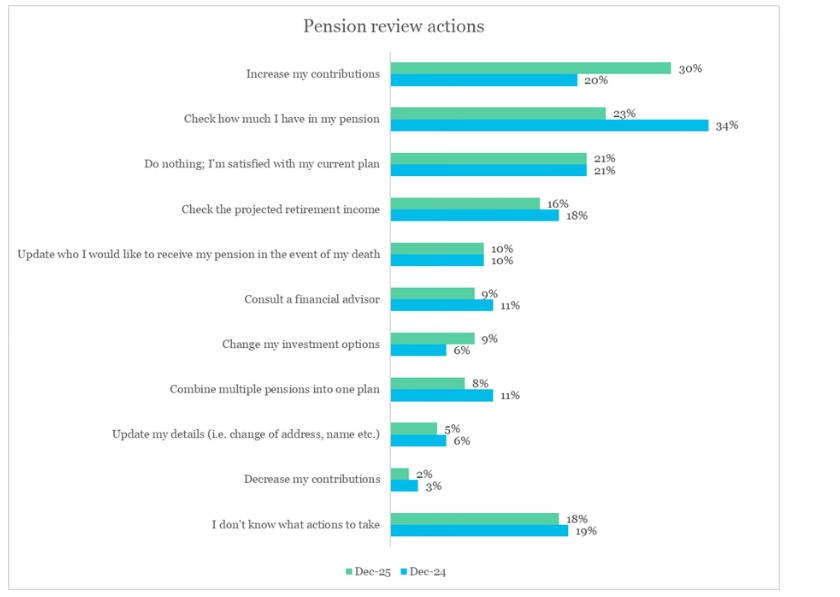

While around one in ten continue to plan to review their pension plan and retirement goals (12%) and increase contributions (10%) as part of their resolutions, the real change comes when people consider what they would do if they undertook a pension review.

Almost a third (30%) now say they would increase their contributions, up nine points since 2025, marking the biggest year-on-year shift in pension behaviour. Among those with defined contribution (DC) pensions, this rises to 34%, and among younger savers under 34, 40% would boost contributions. Higher-income households (£48k+) are also more likely to act (40%) compared to those earning under £14k (19%).

Other actions people say they would take include checking how much they have in their pension (23%), reviewing projected retirement income (16%), updating beneficiaries (10%) and combining pensions into one plan (8%), particularly among younger savers (11% compared to 5% of those aged over 55). Few would consult a financial adviser (9%), change investment options (6%) or decrease contributions (2%). Around one in five (21%) say they are happy with their current plan, while a similar proportion (18%) admit they do not know what steps to take.

Matthew Blakstad, Deputy Director of Strategic Policy and Research, at Pensions UK, said: "The start of a new year is the perfect time to reset financial goals. While everyday needs often take priority, it is encouraging to see people increasingly willing to take action on pensions. However, experience shows that our best-laid plans for our pensions don’t always translate into action.

“Almost a third of savers told us they would increase their contributions if they reviewed their pensions - a significant rise on last year. This demonstrates that the appetite is there and reinforces why government should revisit Automatic Enrolment contribution levels. Many savers are already prepared to pay more, which would help them achieve the lifestyle they want in retirement.

“Whether it’s a small increase in contributions, or just checking your projected income, simple steps today can make a real difference over time. Balancing immediate responsibilities with long-term planning is never easy, but pensions remain a cornerstone of financial security. Whether you are just starting out, or reviewing your plans as retirement draws closer, even small steps can help secure the life you want in the future."

|