The study – published this week – reveals that companies who encourage their employees to contribute above default rates and offer generous benefits packages are outperforming their peers financially.

Scottish Widows worked with research agency Opinium to analyse the views of 1,000 senior decision makers - with responsibility for pensions at their firms - and 2,000 employees for its new report - ‘Retirement Realities: Unlocking The Workplace Benefits.’

The report highlights that two-thirds (64%) of UK businesses that take an active role in educating employees on pensions reported 'very good' financial performance. The quality of financial performance drops significantly - with 18% reporting this as just ‘okay’ - in instances where firms do not play an active role promoting colleague pensions.

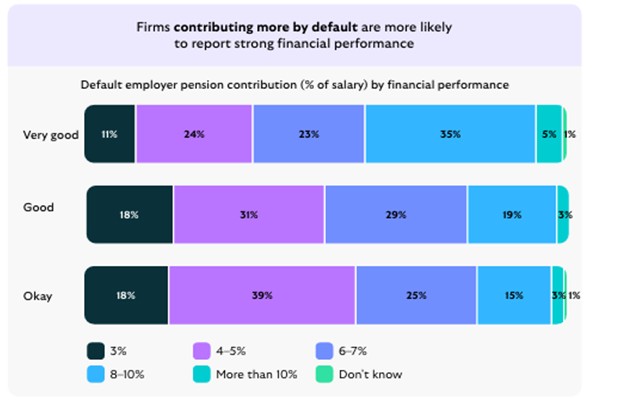

Companies that provide more generous pension contributions also see a positive impact. When asked what percentage of an employee’s salary their employer contributes to their pension by default – more than two in five (41%) of UK firms that pay over 8% into their employees' pensions report 'very good' financial performance. This compares to only 19% among firms that report having an 'okay' financial performance. Just 11% of well-performing firms provide the minimum 3% default contribution required under automatic enrolment.

Graeme Bold, Managing Director, Workplace and Intermediary Wealth, Scottish Widows, said: "Workplace pensions are a powerful, yet often overlooked way to shape employees’ long-term financial wellbeing. Our data shows that by investing in pension engagement, employers are not only supporting their employees’ future, but also unlocking stronger financial performance today. This helps to set the foundations for an engaged and productive workforce, which attracts and retains top talent.”

This relationship between benefits and performance is not limited to pensions. The report also found that firms offering more generous non-pension benefits are also more likely to report strong financial performance. For example, just over half of firms (51%) offering healthcare, 48% offering extended maternity and 39% offering paternity leave above the statutory minimum see the best financial results.

Employee retention

Nine out of 10 (88%) of UK employers believe pension-related benefits and support are important to their firm’s financial performance and 91% said this is important for attracting and retaining employees in their sector. While the majority of employees are happy with their workplace pension, the research shows that those who aren’t will vote with their feet. Nearly a third (29%) have already or are considering leaving their job, with 68% dissatisfied by the lack of competitive pension offering. Over a quarter (26%) cited low levels of communication and benefits being difficult to access (21%) as their main reasons for being dissatisfied.

Graeme Bold added: “At the moment we’re in the middle of the industry-led Pension Attention campaign, which is a great opportunity to put pensions at the top of the discussion agenda. But pension engagement is evergreen, so it’s important companies actively discuss their employees’ benefits package all year round. Technology has made this far simpler and it’s becoming increasingly easier to engage with your pension through an app. For example, our Scottish Widows app gives members of our workplace schemes access to all of their pensions and investments in one place, along with tools, support and other products to help them protect their future. This helps employers enable their employees to check 24/7 that they’re on course for their desired lifestyle and put retirement planning at their fingertips.”

|