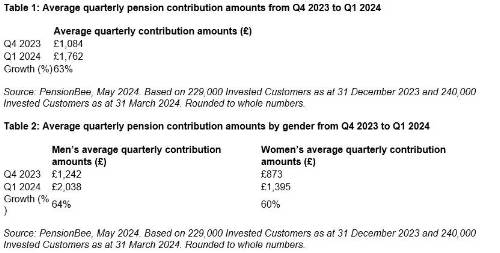

The average quarterly contribution amount for female savers rose by 60%, from £873 in Q4 2023 to £1,395 in Q1 2024. Meanwhile, male savers, who continue to save more into their pensions than their female counterparts, boosted their average quarterly contribution amount by 64%, from £1,242 to £2,038 in the same period.

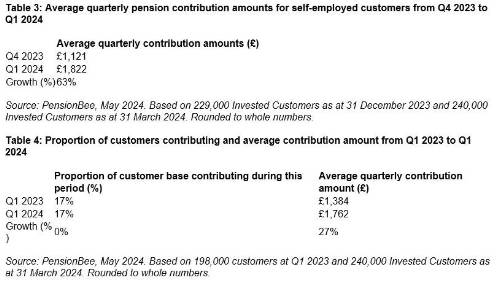

Self-employed savers also gave their pensions a boost in the last 3 months of the tax year, with their average quarterly contribution amount rising by 63% from £1,121 in Q4 2023, to £1,822 in Q1 2024.

While the proportion of customers making contributions remained consistent from Q4 2023 to Q1 2024, compared to the same period the year prior, their average contribution value increased by over a quarter (27%)from £1,384 in Q1 2023 to £1,762 in Q1 2024.

The overall increase in pension contributions could be attributed to savers maximising available tax relief by contributing up to their total earnings for the year into their pensions or taking advantage of the increased annual allowance, which rose from £40,000 to £60,000 in the 2023/24 tax year.

Becky O’Connor, Director of Public Affairs at PensionBee, commented: It’s encouraging to see consumers increasing their pension contributions and taking advantage of the tax benefits associated with this.

Despite the prolonged cost of living pressures, the rise in the annual allowance threshold appears to have motivated pension savers to prioritise their pension contributions.

As we look ahead to the election, the potential reinstatement of the Lifetime Allowance by Labour, if elected, could reshape the limitations of the annual allowance and tax penalties. Regardless of any change in government, the annual allowance must remain generous enough to incentivise consistent pension contributions, as this will enhance consumers’ quality of life at retirement.”

|