|

|

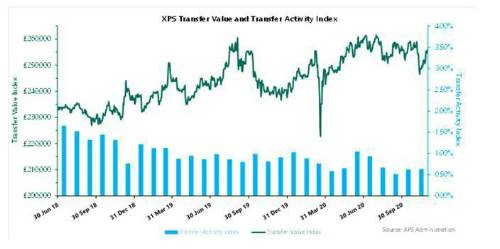

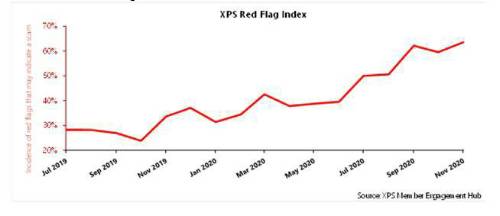

XPS Pension Group’s Transfer Watch monitors how market developments have affected transfer values for a typical pension scheme member. It also monitors how many members are choosing to take a transfer from their DB pension scheme and through its Red Flag Index shows the incidence of scam red flags identified at the point of transfer. |

November saw a new high in the Red Flag Index, with 64% of transfers showing at least one warning sign of a potential scam. Transfer activity remained steady and transfer values finished the month largely unchanged, although this masks some volatility throughout November. This month also saw a further ruling in the Lloyds Bank GMP equalisation case. The high court has determined that pension schemes now need to revisit up to 30 years’ worth of past transfers and pay top-ups where necessary. Mark Barlow, Partner, XPS Pensions Group commented: “November was a turbulent month with England’s second national lockdown and the US election and Brexit remaining in the headlines. As a result, it is no surprise that transfer values were volatile.” “It is concerning that we continue to see such high volumes of cases raising red flags of pension scams. The recent Lloyds Bank case will result in pension schemes making one off payments to many former members, presenting a further opportunity for scammers. It is vital that trustees and sponsors do all they can to protect their members, including signing up for the Pensions Regulator’s pledge to combat pension scams.”

XPS are running a live webinar on Tuesday 15th December focussing on the practical steps schemes can take to protect members, with a panel including the Rt Hon Stephen Timms, Margaret Snowdon OBE and Martin Broomfield, TPR’s Head of Intelligence. Further details and to register can be found here: XPS Live | Let’s Stand up for Members and Stamp out Pension Scams

Chart 1 – XPS Transfer Value and Transfer Activity Index

Chart 2 – XPS Red Flag Index

|

|

|

|

| Senior Pricing & Portfolio Management... | ||

| London - £150,000 Per Annum | ||

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.