The fall in gilt yields and resulting increase in liabilities were slightly offset extent by long-term inflation expectations falling by 0.1% over the month, reducing pension scheme liabilities.

A strong performance by equity and corporate bond markets, particularly for UK markets, offset the impact of falling gilt yields further, meaning funding levels remained relatively stable over the period.

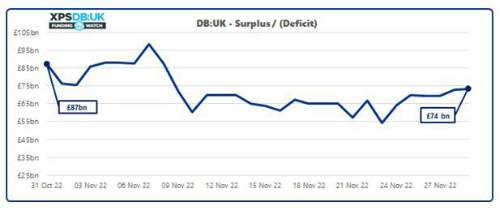

UK pension schemes’ funding positions have fallen by c.£13bn over the month to 29 November 2022 against long-term funding targets, an analysis from XPS’s DB:UK funding tracker has revealed. Based on assets of £1,559bn and liabilities of £1,485bn, the aggregate funding level of UK pension schemes on a long-term target basis was 105% as of 29 November 2022.

Following a period of significant volatility in the gilt market during September and October, yields stabilised during November as nominal gilt yields ended the month down 0.4%, while long-term inflation expectations continued to fall.

Tom Birkin, Actuary at XPS Pensions Group said: “Following the unprecedented market turmoil and collateral call issues we’ve seen over the previous two months, November was a much-needed period of relative calm for pension schemes.

Many pension schemes remain in a very healthy position and should be exploring options to de-risk and lock in some of the gains made during 2022, including full or partial buy-ins. With the bulk annuity market getting busier and some insurers becoming more selective, it’s important for schemes to prepare well before any market approach.”

|