XPS DB:UK estimates that it will currently take the average scheme just over 1 year1 to reach its long-term target under the proposed new funding code rules.

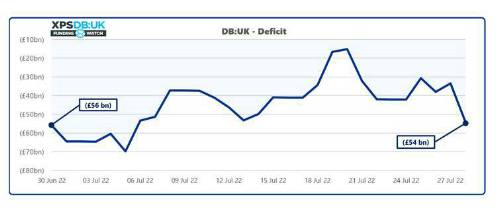

Deficits of UK pension schemes have decreased by c.£2bn over the month to 28 July 2022 against long-term funding targets, an analysis from XPS’s funding tracker XPS DB:UK has revealed. Based on assets of £1,685bn and liabilities of £1,739bn, the aggregate funding level of UK pension schemes on a long-term target basis was 97% as of 28 July 2022. XPS estimates that at the end of July 2022 the average pension scheme would need an additional £5,000 per member to ensure it can pay their pensions into the long-term.

Drivers of the change

Inflation continues to have a large impact on pension scheme liabilities, with current levels driving up benefits. A slight fall in long-term inflation expectations contributed towards a marginal improvement in funding levels over July despite a slight fall in gilt yields. This adds to the improvements in long-term positions that we have seen over 2022 – cumulative improvements that are now in excess of £270bn.

Towards the end of the month Federal Reserve Chair Jerome Powell stated that any decisions around increasing interest rates in their September meeting “will depend on the data we get between now and then"2. This is a slight softening in the Fed’s position as the market has been expecting the sustained rate rises that we have consistently seen in recent announcements. US markets reacted positively to indications that the Fed will keep an open mind in September, providing a small boost to growth assets at the end of the month.

Felix Currell, Senior Investment Consultant at XPS Pensions Group said: “Whilst July has seen pension scheme liabilities stay fairly flat compared to recent months, hedging strategies continue to be under stress. Many schemes that use leveraged liability-driven investment products have been required to post significant collateral, bringing forward the need for trustees to consider the liquidity position of their schemes. The threat of global recession still looms over growth markets, however it was interesting to see the positive response in US equities in particular following the Fed’s announcements.”

|