The Broadstone Sirius Index found that the impact of higher-than-expected inflation on scheme funding was offset by interest rate rises in June.

Higher than expected inflation for a sustained period alongside higher historical inflationary increases feeding through into June have increased the present value of liabilities. These increases were offset by expected falls in liability values caused by a rise in interest rates, the combined impact being a liability increase of 0.5%.

The Bank of England’s Base Rate decision had a lower impact than expected as rising short term rates were partially offset by falling longer term rates, further inverting the yield curve.

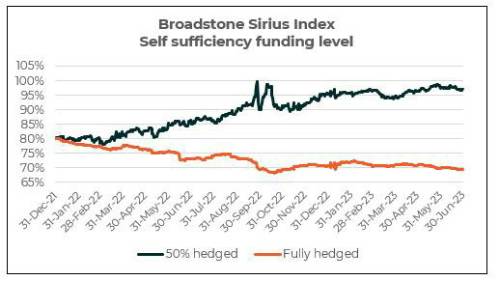

Our fully hedged scheme's funding position has remained steady at 70%.

Our half hedged scheme has also maintained its funding position at 97%.

Chris Rice, Head of Trustee Services at Broadstone noted "After a dramatic month of May which saw large rises in yields, June has been a lot quieter. We expected more volatility given the interest rate rise from the Bank of England, but while that decision causes issues for individuals, defined benefit pension schemes have been largely immune with markets not moving as one may have expected.”

“An inverted yield curve is often considered as an indicator of a forthcoming recession, so Trustees should be discussing with their investment consultant the extent to which the scheme’s investment strategy can weather this potential scenario.”

“Inflation is often discussed in pension schemes as being of lower impact because of the various caps and collars constraining its influence on benefits. However, if expectations of prolonged high inflation are true, the present value of the liabilities will begin to creep up too.”

“We expect that Trustees will be discussing the impact of higher-than-expected inflation with their Scheme Actuary, both the impact on funding, and member benefit calculations.”

|