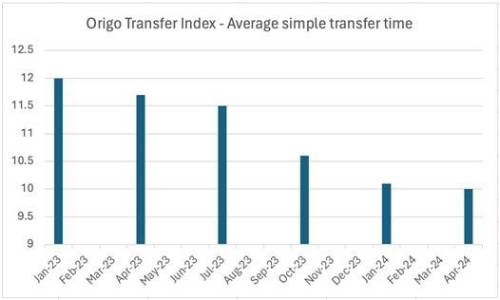

Times for simple transfers, i.e. those where the provider has complete control over and can reasonably be held fully accountable for the process, have improved by 16.7%, from 12 calendar days to 10 calendar days, over the same period.

The data is for transfers through the Origo Transfer Service for the 12 months to 31 March 2024. The Service accounts for around 95% of all DC pension transfers in the UK market.

During the period under review, almost 1.2 million transfers were completed through the Service.

The Origo Transfer Index is published quarterly and tracks the transfer times of 30 voluntary participants, including the biggest names in the industry. It was established in 2019 to increase transparency around pension transfers and to help to improve the performance of the industry overall. The 30 participants account for 92% of the pension transfers carried out through the Transfer Service, making the Index a reliable market indicator.

Anthony Rafferty, CEO, Origo says: “It is encouraging to see the continued improvement in transfer times over the past 15 months, which we feel reflects a growing movement within the industry to improve the consumer experience.

“This is particularly pleasing ahead of the Pensions Dashboard staging dates, and demonstrates how technology can help, by automating and digitalising the transfer process and making it trackable.

“We are seeing a general move within the industry to deliver better performance, with providers looking at where and how they can improve their products and in particular their service, to ensure they present the best option for consumers in where to save.

“There is a realisation that service is being measured at both the front end, when onboarding business, and also within the back-office and when business is moving away to another provider. Both are affecting the brand and reputation of providers, and we believe will increasingly affect where business is placed in the future.

“We are seeing this not just in transfers through the well-established Origo Transfer Service, but also in the growing number of providers signing to Unipass Letter of Authority, now at 16 and growing, as well as take up of the Origo Integration Hub, with over 100 connections made between companies across a range of services.

“All of which we see as very positive for the industry.”

|