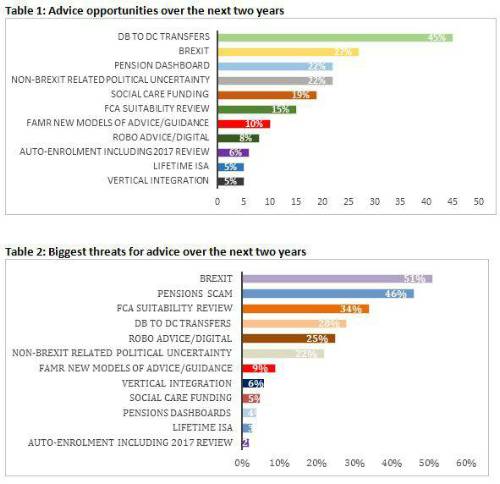

Aegon research found that advisers see Brexit as the biggest threat to the advice sector, chosen by just over one half (51%) of those surveyed. However it also scores high on the opportunities list. Over a quarter (27%) of advisers viewed Brexit as a key opportunity, with another 22% viewing non-Brexit political uncertainty as an opportunity.

For the second year running, DB to DC transfers tops the opportunities list with just under half (45%) of UK financial advisers viewing this as a key area for growth. This comes despite some commentators speculating that the transfer market may have peaked and as the FCA’s new guidelines on transfer advice begin to bed in.

Disappointingly, new models of advice or guidance from the Financial Advice Market Review were seen as an opportunity by only 10% of advisers, suggesting FAMR has not yet delivered to its potential. This raises the stakes for the FCA’s promised 2019 review of FAMR and the Retail Distribution Review.

The research showed pension scams were also considered a significant threat to the industry with just under a half (46%) of advisers worried about this issue. The recent implementation of the cold calling ban should hopefully reduce these concerns going forward.

Steven Cameron, Pensions Director at Aegon, comments:

On Brexit

“It would take a brave person to attempt to predict with any certainty the macro economic or political implications of Brexit and how investment markets will perform as we seek a Brexit deal and then move through the process of leaving the EU. Advisers may fear that any damage to the UK’s economic performance may mean less new money for individuals and employers to invest. However, those with existing investments will need help to ride out short term uncertainty without damaging long term prospects, creating a major advice opportunity. In times of uncertainty, professional advice can add huge value.”

On DB Transfers

“It is no surprise that DB to DC transfers continues to be viewed as the biggest opportunity for advice. Whilst transfers volumes may have declined from a peak at the beginning of 2018, demand for such advice continues to outstrip supply and as advisers gain confidence in the recent FCA guidance, which sets out its expectations of ‘what good looks like’, we expect to see numbers rise again. However, we need to resolve issues obtaining PI insurance.”

On Financial Advice Market Review

“The biggest disappointment, if not surprise, is that the Financial Advice Market Review is failing to register as offering an opportunity. This joint Treasury / FCA initiative to help close the ‘advice gap’ generating 28 recommendations, all of which have been taken forward in some shape or form and really should have been an opportunity to further strengthen the advice market. While other Aegon research points to advisers continuing to support the principles, the unfortunate reality is nothing much has changed in practice. With the FCA promising a 2019 review of FAMR and the Retail Distribution Review, the stakes are high to find ways of delivering on some of this potential.”

|