More than 720,000 over 65s checked their eligibility for State Benefits last year because of the government’s means-tested financial package to support households through the cost of living crisis, research by advisory firm HUB Financial Solutions reveals.

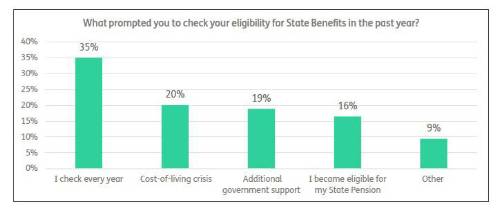

Data from a survey of 1,002 UK adults aged over 65 found that a third (33%) of over 65s said that they had checked their entitlement to State Benefits in the last year. Of these people, around one in five (19%) said that they had done so because of the government’s means-tested financial help aimed at supporting those on benefits through the cost of living crisis.

The financial strain felt by households due to the rising cost of day-to-day living also drove a similar proportion (20%) to check their benefit eligibility, while 16% were prompted to check after they started to receive the State Pension.

The government means-tested package meant that those claiming Pension Credit qualified for cost of living payments totalling an extra £900 a year to help those most in need.

“The financial pressures over the past year have placed immense stress on household budgets,” said Simon Gray, Managing Director of HUB Financial Solutions, “and pensioners can be particularly exposed given that a significant proportion of them rely on the State Pension to provide the greatest part of their retirement income.”

“Unexpected one-off costs or widespread inflationary pressures can hit pensioners on low incomes especially hard. Targeted benefits like Pension Credit exist specifically to support these pensioners with their living costs, and increasing uptake is critical to ensuring they have a decent standard of living in retirement.”

Data from the DWP suggests that of those eligible for Pension Credit, just 77% are claiming leading to £1.7 billion of available Pension Credit being lost each year.

“We would urge all pensioners to check regularly to see if they are entitled to additional state support. There is a huge range of benefits to help with a variety of circumstances, it is easy to check eligibility and there is a lot of support out there to help people claim,” said Simon Gray.

|