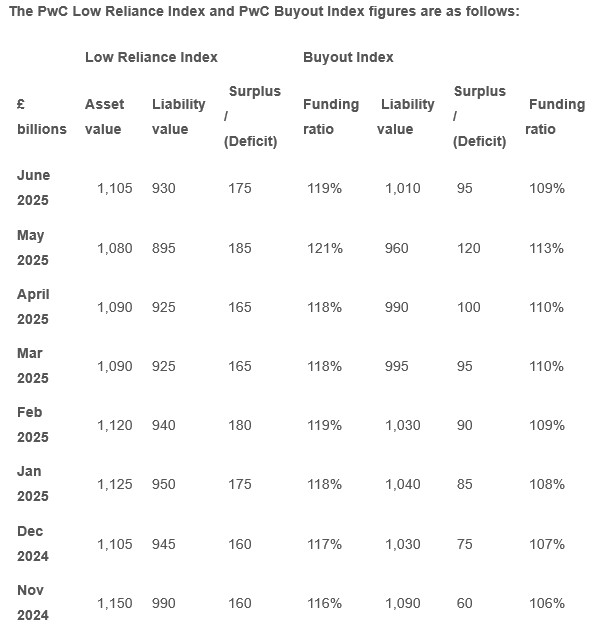

Meanwhile, PwC’s Buyout Index, which measures the estimated cost for UK DB pension schemes to fully insure their liabilities via buyout with an insurer, also recorded a surplus position of £95bn, demonstrating that schemes continue to have, on average, sufficient assets to ‘buyout’ their pension promises.

These levels of DB scheme surplus are a key focus for the Government, with a “once-in-a-generation” Pensions Bill read in Parliament last month - this is intended to allow surplus funds above a set threshold to be extracted, with trustee agreement and safeguards.

Saye Mkangama, Pensions Partner at PwC, said: “The strong position of the UK’s DB pension schemes reflects a trend in recent years of higher funding levels and higher resilience of investment strategies to market volatility. This strength means that sponsors and trustees are able to explore the opportunities presented by the shifting landscape with more certainty than has been the case in the past. For the first time in a generation, sponsors may be able to unlock meaningful value from their pension schemes and deliver better outcomes for all stakeholders - all while continuing to protect members’ benefits.

“In light of the Government’s recent publication on accessing surplus, many schemes are actively revisiting their plans - weighing up whether running-on for a period to build and use surplus would be appropriate in their situation. The amount of surplus available will vary, but in some cases, up to 25% of scheme assets could be available over time. Whilst market practice is still emerging, and for some insurance buyout will remain the right answer, we expect the total amount of surplus released to be significantly higher than estimated in the Government’s own impact assessment.”

Katie Lightstone, Pensions Covenant Partner at PwC, added: “For many sponsors of well-funded schemes, their greatest risk now may be closing the door to future opportunity. It would be wise therefore, to fully consider the implications and options now on the table, before proceeding with an irreversible move to buyout. The Pensions Bill could also see fundamental changes to how pension schemes are viewed in a deals or restructuring situation. In these cases, early engagement and re-assessing the pension scheme will be even more crucial."

|