Standard Life analysis shows pensions can deliver better outcomes for most retirement savers, driven by tax relief on contributions, a benefit that may also help offset additional inheritance tax (IHT) payments after the April 2027 rule change.

From April 2027, most unused pension funds and death benefits will be included in the value of a person’s estate for inheritance tax (IHT) purposes. While this change is expected to affect only the wealthiest estates, it could lead to reduced confidence in pensions and prompt some savers to reconsider their retirement saving approach. Research supported by Standard Life found 16% of defined contribution pension savers are likely to withdraw funds earlier than planned due to the IHT change, and 11% are considering cutting contributions*.

Pensions pay off for retirement saving

Reducing contributions or moving retirement saving away from pensions could lead to worse outcomes. Unlike many other long-term saving products, a pension benefits from tax relief at an individual’s highest marginal rate, enabling savers to have the potential to build a larger fund for retirement. Pensions also have a higher annual allowance than an ISA allowing for larger savings and better retirement income potential.

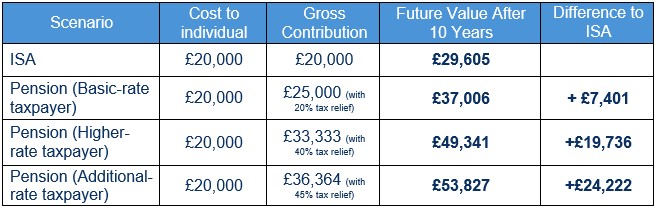

A £20,000 investment in an ISA could grow to around £29,605 over ten years. By comparison, a pension contribution with the same £20,000 net cost, boosted by tax relief, could grow to around £37,006 for a basic-rate taxpayer and up to £49,341 for a higher-rate taxpayer**. Figures are based on an assumed return of 4% per annum after charges.

Standard Life analysis**. Table highlights the additional amounts that can be invested into a pension compared to an ISA for the same net cost and the difference this can make over 10 years. Figures based on an assumed return of 4% per annum after charges. Figures in monetary terms.

For those in a workplace pension scheme, regular contributions are also enhanced by valuable employer contributions. When taking money from a pension, 25% of the withdrawal is tax free, while the remaining 75% is taxed as income. By contrast, all ISA withdrawals are completely tax free. Although this tax treatment reduces the net return from a pension, pensions can still provide greater overall benefits, particularly when individuals receive a higher rate of tax relief on contributions paid in to the pension than the rate at which they are taxed when drawing on the fund.

Pensions will typically match ISAs for wealth transfer after IHT change

For most estates, unused pension funds will continue to pass on free of IHT post April 2027, as total estate values typically fall below the nil-rate band. A surviving spouse with a home can benefit from a combined threshold of up to £1 million.

For estates exceeding the threshold after the IHT rule change, any unused pension funds will attract inheritance tax at 40%, similar to other assets. In addition, unlike ISAs, withdrawals from inherited pensions may also be subject to income tax at the beneficiary’s marginal rate (if death occurs after age 75). This combined tax treatment could make alternatives appear more appealing for wealth transfer. However, the upfront tax relief on pension contributions remains a significant benefit. Meaning even after the IHT change, inheriting a pension is unlikely to leave individuals any worse off compared to other assets. Where death occurs before age 75, pensions could offer better wealth transfer returns as the withdrawals are usually free of income tax.

Neil Jones, tax and estate planning specialist at Standard Life, comments: “Including pensions within the scope of inheritance tax represents one of the most significant changes to estate planning in decades. While the impact will primarily be felt by the wealthiest estates, there is a risk that pensions begin to be viewed less favourably by the wider saving population who are unlikely to be affected.

“Pensions remain one of the most powerful tools for building retirement income, thanks to the combined benefits of tax relief and employer contributions for eligible employees. Diverting savings away from pensions into alternatives could have long-term consequences for people’s financial security later in life. For those focused on wealth transfer, estates that may face IHT should remember that the upfront tax relief on pension contributions may offset any additional tax payable under the new rules. Seeking advice from a professional financial adviser remains the best way to navigate estate planning options.”

|