The latest figures show that 3.9 million people aged between 55 and 64 have ISAs worth an average of £40,945.

While money can normally be taken from ISAs at any time, flexible pension rules mean investors can access pensions from 55 years old (57 from 2028), taking the money as lump sums if they wish.

And the impact of pension tax relief means returns could be boosted by up to 41.6% for higher rate taxpayers

Sean McCann, Chartered Financial Planner at financial advisory firm NFU Mutual, said: “Unless you’re about to retire, pensions can seem like a bit of a dull subject – but if you’re in your fifties or older, they can offer a whole new way of thinking about investment. “Once you reach 55 you can take money from your pension either as lump sums, income or both. This means they can offer an attractive alternative to ISAs if you’re looking to build up funds for the future. Latest figures show 3.9 million people aged between 55 and 64 hold ISAs with an average value of £40,945 – but many of them could be better off topping up their pension and claiming the tax relief. The tax boost you get when you put money into a pension can make a huge difference to returns.”

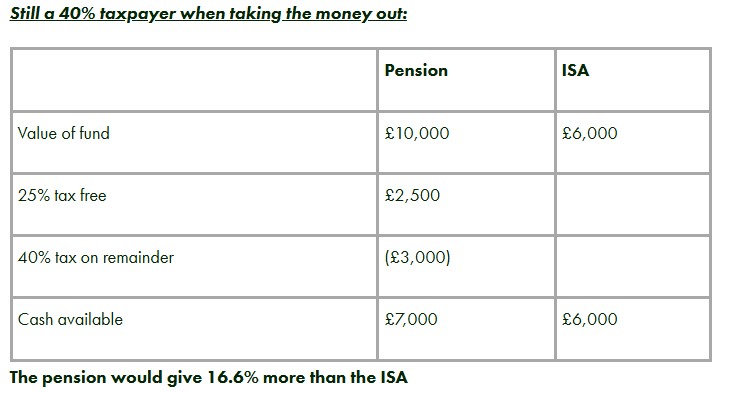

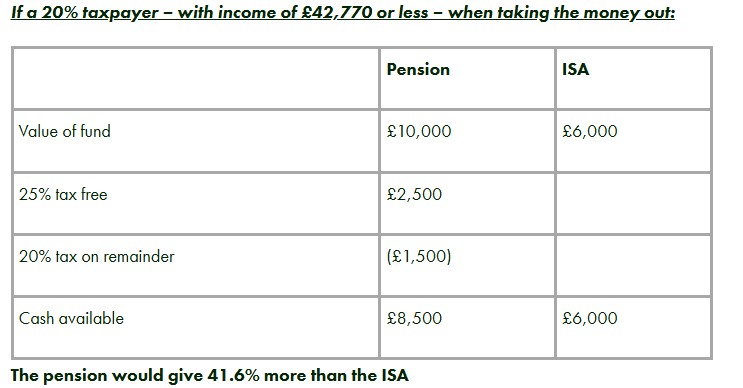

Higher rate taxpayer example

Over 55, earning £60,500 a year and with £6,000 to invest

As a 40% income taxpayer, £8,000 could be invested into a pension – HMRC would then boost with a further £2,000 giving them a fund of £10,000.

Up to an additional £2,000 can then be claimed back direct from HMRC, meaning cost to them to create a £10,000 fund would be £6,000

Assumes no growth and no charges

Sean McCann added: ‘Although currently any money left in your pensions is normally free from Inheritance Tax, this is set to change from April 2027, with unspent funds set to be included in the inheritance tax calculation, bringing them into line with the Inheritance tax treatment of ISAs. If you die before 75, in most cases, the benefits from pensions can be paid free of Income Tax, although there are limits if paid as a lump sum. If you die after 75 your beneficiaries will be taxed on the money paid out to them after any inheritance due has been paid.’’

|