Adviser workloads are set to rocket in the run up to pension IHT changes set for 6 April 2027. The implications are significant with 77% expecting their workload to rise ahead of April 2027, with an average increase of 20%.

The plight of hard-working advisers is revealed in new research from Standard Life as a large volume of their clients will need reviews of financial plans. Advisers estimate around 40% of clients require a review of their existing plans.

The change, announced in last year’s Budget, is designed to discourage the use of pensions as a wealth transfer tool, which has grown in popularity since the introduction of the pension freedoms in 2015.

Voice of Reason

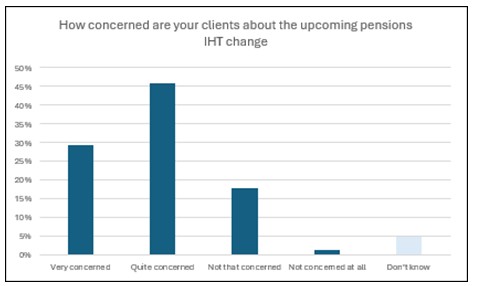

Advisers also have an important role in reassuring clients and explaining the new regulations. 76% say their clients are concerned about the upcoming IHT change, and 30% report that these concerns are very high.

For clients in the accumulation phase, concerns are focused on decisions about pension contributions. Nearly half of advisers surveyed (48%) say clients have asked whether they should reduce or stop contributions. And a further 38% expect additional queries around this in the near future.

Planning assumptions turned on their head

For clients in decumulation, the most immediate concern is around the pension fund itself. For the last decade, the general principle for wealthier individuals has been to draw income from ISAs, savings, and other investments first, leaving the pension to grow in a tax-efficient environment, with any unused funds passing on IHT-free. The upcoming policy change has turned this assumption on its head, prompting advisers to reassess retirement strategies and explore alternative solutions.

Warren Bright, Head of Retail Intermediary and Private Client Distribution at Standard Life, comments: “The aftershock of the 2024 budget announcement continues to be felt across the pensions industry as the reality of pensions coming into scope of IHT from April 2027 sinks in. What might appear to be a simple change is far from straightforward and advisers are at the sharp end, supporting their clients through the change. It’s clear from our research that advisers have an uphill challenge reviewing financial plans and making adjustments for those affected before the implementation date.

“Worryingly, the long-term effect on saving behaviour remains uncertain, but it would be disastrous for the financial health of generations of savers if this change discourages them from pension saving. Importantly, for most people, IHT on pensions will not apply because their estates fall below the threshold. Pensions will continue to be one of the best ways to save for retirement, benefiting from tax-relief and employer contributions, and this won’t change under the new rules.”

Alternative solution knowledge gap

For some advisers, particularly those who’ve entered the industry in the last ten years, there’s been much more limited use of alternative product solutions. 57% of advisers say they need to refresh or improve their knowledge on alternative strategies. Trusts, onshore and offshore bonds, gifting, and annuities are all expected to increase in popularity.

Standard Life has been supporting advisers through this change developing resources and content. The most recent IHT webinar attracted nearly 1,000 registrations with around 100 follow-up questions. The most common questions were around ways to reduce pension IHT exposure.

|