|

|

This update provides the latest estimated funding position, based on adjusting the scheme valuation data supplied to The Pensions Regulator as part of the schemes’ annual scheme returns, on a section 179 (s179) basis, for the defined benefit pension schemes potentially eligible for entry to the Pension Protection Fund (PPF). |

This edition follows publication of The Purple Book 2025. As such, we’ve updated the index – including retrospectively from March 2025 – to reflect the latest data.

In the government’s Autumn Budget, it announced it would legislate to allow us to pay prospective indexation from 2027 for service accrued pre-1997. Work is underway to enhance the 7800 to approximately quantify this change, and it will be implemented in the coming months. For now, the figures in the 7800 make no allowance for indexation on pre 97 pension. See the notes for editors for more detail on the estimated impact.

December update (at 30 November 2025)

A scheme’s s179 liabilities represent, broadly speaking, the premium that would have to be paid to an insurance company to take on the payment of PPF levels of compensation. This compensation may be lower than full scheme benefits.

Highlights

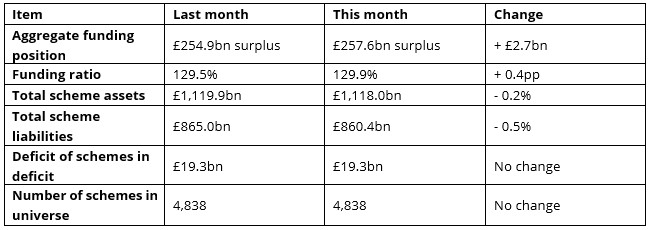

Shalin Bhagwan, PPF Chief Actuary, said: "Each December, after releasing The Purple Book, we update the 7800 Index. This ensures that our dataset is more up-to-date and provides a clearer picture of the schemes we protect, helping us better understand the risks we face. This means the figures quoted for last month (as at 31 October 2025) have been restated to reflect the new data we have access to.

“This month's 7800, using the latest data, paints a picture of stability in the estimated funding of the eligible universe of DB schemes, with gilt yields largely unchanged at the month-end and equity markets fairly flat throughout November. The s179 funding ratio inched up by 0.4 percentage points, as estimated liability values fell slightly more than estimated scheme assets values, while the aggregate s179 funding position improved by £2.7bn to a £257.6bn surplus."

View the December update and see the supporting data on the 7800 Index for 30 November 2025 here: The PPF 7800 index | Pension Protection Fund.

|

|

|

|

| Senior Pricing & Portfolio Management... | ||

| London - £150,000 Per Annum | ||

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.