|

|

This update provides the latest estimated funding position, based on adjusting the scheme valuation data supplied to The Pensions Regulator as part of the schemes’ annual scheme returns, on a section 179 (s179) basis, for the defined benefit pension schemes potentially eligible for entry to the Pension Protection Fund (PPF). |

A scheme’s s179 liabilities represent, broadly speaking, the premium that would have to be paid to an insurance company to take on the payment of PPF levels of compensation. This compensation may be lower than full scheme benefits.

Highlights

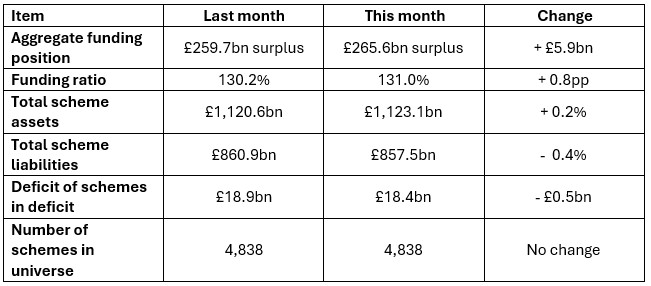

Shalin Bhagwan, PPF Chief Actuary, said: "The PPF-eligible DB universe's funding position strengthened slightly over the last month, with the funding ratio increasing to 131.0 per cent from 130.2 per cent at the end of last month and the aggregate surplus reaching £265.6 billion, compared with a surplus of £259.7 billion at the end of December 2025.

The increase in schemes’ funding position resulted from a 0.2 per cent increase in total scheme assets, to £1,123.1 billion, and a 0.4 per cent decrease in total scheme liabilities, to £857.5 billion. These movements were driven in large part by a mixed bag of shifts in bond yields over the month - with yields on fixed interest indices moving up but, consistent with increases in inflation expectations, real yields falling, while equity markets saw positive returns."

View the February update and see the supporting data on the 7800 Index for 31 January 2026 here: The PPF 7800 index | Pension Protection Fund.

|

|

|

|

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.