Previous Phoenix Insights research found life events, such as motherhood, menopause and caring responsibilities, disproportionately affect women’s saving capacity, exacerbating the pensions gender gap

Worries around pre-retirement living costs will likely worsen the gender pensions gap, as a greater number of women than men expect to access their retirement pot earlier than planned to support their income.

Research by Phoenix Insights, Phoenix Group’s longevity think tank, surveyed 2,500 adults over 45 who are not yet retired and found 4 in 10 (40%) women expect to dip into their retirement savings earlier than planned, compared to 3 in 10 (32%) of men. This was despite 44% of women over 45 acknowledging they currently have insufficient funds to support them through retirement.

DWP estimates suggest the gender pension gap in private pensions is 35%. Pay disparity is a big contributor to this, but Phoenix Insights’ report, Caught in a Gap, highlights that the life stages women can go through – such as motherhood, divorce, menopause and caring responsibilities – also disproportionately affect earnings, and consequently women’s capacity to save. By mid-life (aged 45-54) men are saving 50% more into their workplace pension than women.

Catherine Foot, Director of Phoenix Insights, said: “As many as 18 million people in the UK are not adequately financially prepared for later life, and a disproportionate number of these are women. The research suggests more women than men will access their retirement savings earlier than planned, so this will likely exacerbate the issue.

“For meaningful progress in this area, we need to make saving more accessible, especially for those on low incomes and working part-time. Some women have been trapped in a cycle of being unable to pay into their pension either through a lack of affordability or because they are excluded entirely from workplace pension saving. Our research found women are over three times more likely than men to fall under the earnings threshold for auto enrolment.

“There is also limited awareness over the causes and consequences of the gender pension gap. Pay is a significant contributor but we shouldn’t overlook the key life events women can go through – such as motherhood, ill health or caring responsibilities – which impact savings. We need polices that seek to improve the savings capacity of women across the different life stages, and encourage employers to go above and beyond the minimum levels of support.”

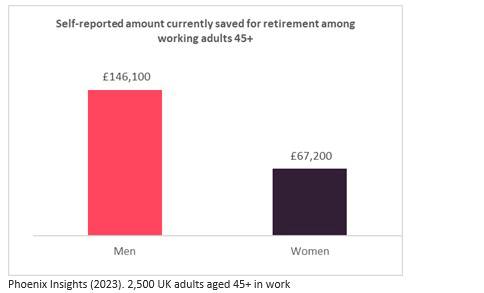

Quantifying the gender savings gap for over 45s

The research found men over 45 have saved on average £146.1k for retirement, more than twice the average amount women have saved (£67.2k). However, there was also a significant proportion of adults (31%) who had no idea how much they have saved.

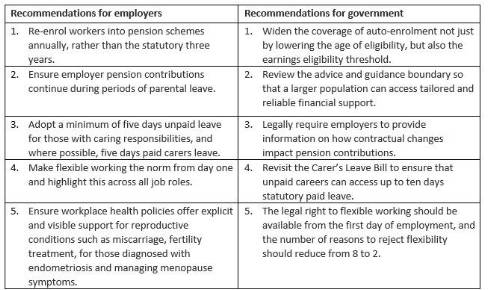

Phoenix Insights’ 5 key recommendations for employers and government to help support women’s future finances

Recommendations from Phoenix Insights (2023), Caught in a Gap report

|