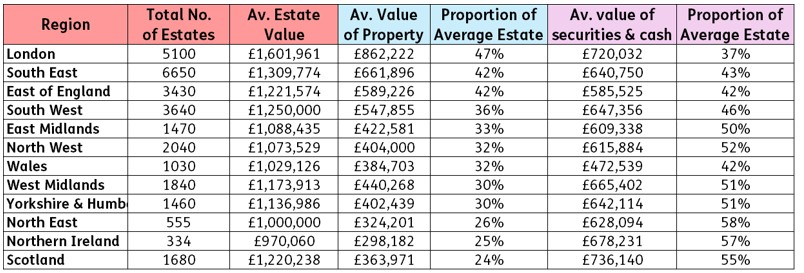

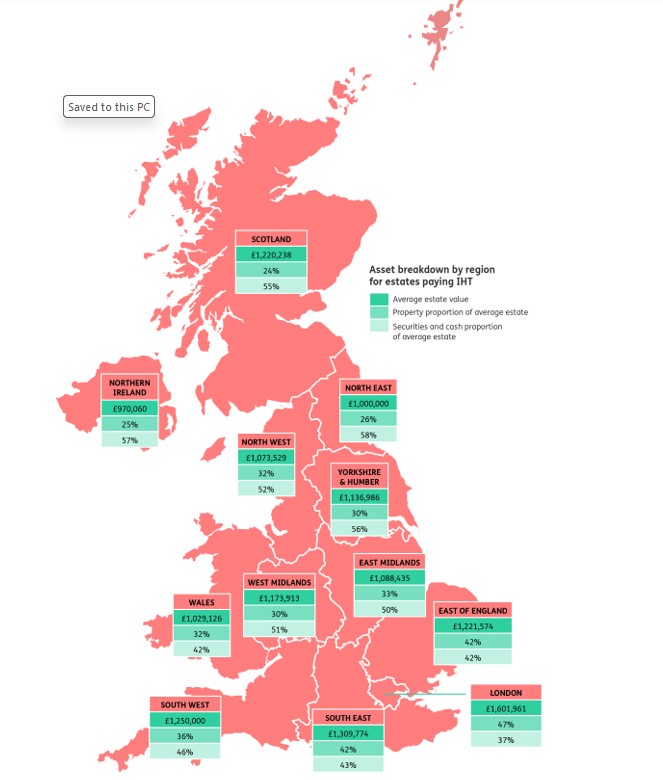

An HMRC Freedom of Information request from retirement specialist Just Group reveals that property makes up nearly half (47%) of the wealth in estates paying Inheritance Tax (IHT) in London, with the majority of regions being around a third and above.

In 2022-23 (the latest financial year of data available), property accounted for 47% of the wealth in estates paying IHT in London, with the average property value exceeding £862,000. The average estate value in the capital was over £1.6 million, nearly £400,000 higher than the East of England which held joint second highest average estate value with the South East.

Property wealth makes up around a quarter of the value of the average IHT-paying estate in Scotland (24%), Northern Ireland (25%) and the North East (26%).

Source: FOI request from Just Group to HMRC for the Asset Breakdown by Region for Taxpaying Estates in 2022-23 – latest available data

Cash and securities make up a far larger proportion of estates in regions other than London, East and South East – although substantially fewer estates are liable for IHT outside those three areas. It suggests that high house prices in London, East and South East have been largely responsible for pushing more estates into paying IHT.

David Cooper, Director at the retirement specialist Just Group, commented: “Our Freedom of Information request seeks to uncover how important property is when it comes to estates that pay Inheritance Tax, especially in those areas with the highest house prices.

“It is evident that housing wealth in regions like London, the East and the South East makes up a larger proportion of the estates compared to other regions. The average value of property in London estates paying IHT is nearly double that of most other regions across the UK.

“The introduction of the residence nil-rate band in 2015 reduced the IHT due for some of those leaving property to a direct descendant but the threshold has been held at £175,000 since 2021. With asset prices continuing to grow and the IHT regime seeing a significant tightening in the Autumn Budget 2024, it’s likely more people will be dragged into paying the tax through the value of their property.

“Estate planning is a complex area that can benefit from professional financial advice. A professional adviser can help people who want to manage their estate in an efficient way and ensure as much as possible can be passed on to loved ones.”

|